Connect With Ecosystem Catalysts

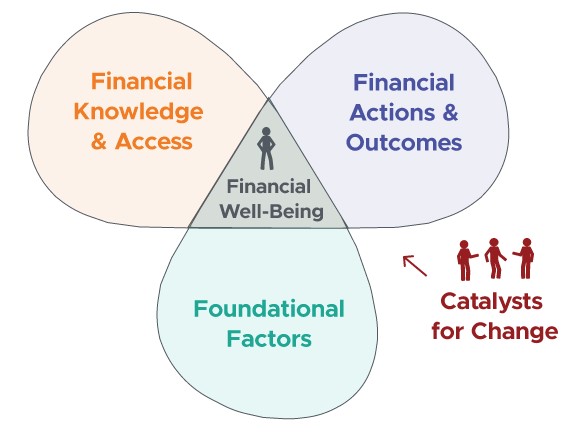

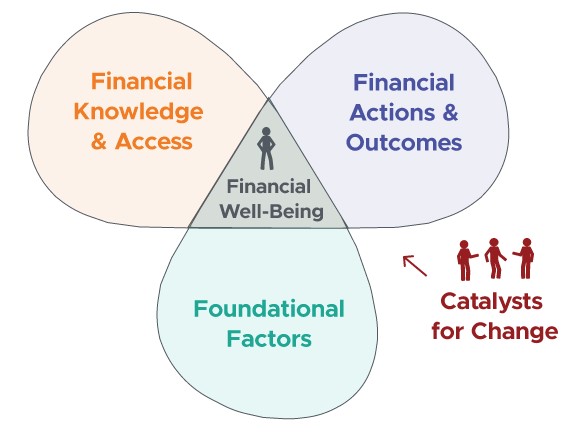

Catalysts for Change seek to impact individuals’ financial well-being by influencing different aspects of the Personal Finance Ecosystem. They are the interventions, organizations, and movements— and the people power—that comprise the financial well-being field.

Learn More About NEFE’s Role in the Ecosystem

Knowledge Influencers

Knowledge Influencers are a variety of engagements implemented with the purpose of increasing an individual’s overall financial knowledge and decision-making skills or informing them about a specific, narrow topic.

Some Knowledge Influencers are financial educators who use learning techniques to support learners with incorporating new knowledge into their existing mental models. Others provide financial information and tools, often as part of self-directed inquiry or to support behavioral interventions.

While Knowledge Influencers may end up changing behavior, the desired outcome is knowledge gain

Learn MoreKnowledge Influencer examples

- Classroom teachers in formal education settings.

- Instructional designers creating curricula for their state’s personal finance courses.

- Volunteers delivering workshops on various financial topics within their communities.

- Nonprofit organizations offering educational information directly to consumers via their websites and social media channels.

- A local elder care firm offering resources to prevent fraud among seniors.

- Lenders creating mortgage calculators for prospective customers.

- Bloggers detailing personal experiences of navigating complex financial decisions and tasks to provide transparent information to their subscribers.

Is there a difference between financial education and financial information and tools?

Yes, these are two distinct categories of intervention.

- Financial education is a systematic approach to cultivating financial knowledge and financial decision-making skills, and it implies the use of appropriate pedagogy, learning objectives, and time of instruction. Quality and dose matter for what we can expect it to achieve. An example is a semester-long personal finance course taught with a trained educator and a culturally responsive curriculum.

- Financial information and tools are a variety of resources and activities that inform individuals about a topic or decision. They can and should be used as part of a financial education program or initiative, but on their own do not constitute education as they lack the pedagogy, learning outcomes, assessment techniques, and sufficient duration and intent for the learner to fully assimilate the information into lasting knowledge. Examples include small-dose lessons not part of a broader curriculum, articles and reference resources, calculators, and tips and tricks.

Both are implemented to increase the individual’s overall financial knowledge and decision-making skills or to inform about a specific, narrow topic. However, financial education has a higher level of impact on knowledge and decision-making skills.

Differentiating between the two has implications for what the intervention can reasonably achieve. For example, informational fliers likely won’t have the lasting impact of a full-semester personal finance course.

Structural Policy Change

While policies can impact each aspect of the Ecosystem, Structural Policy Changes have strong leverage on access and inclusion. The goal of using structural changes to influence financial well-being is to remove systemic barriers to full participation in the formal financial system and all aspects of financial society. It’s important to note that barriers to full participation in financial society are largely systemic, and systemic issues can only be addressed with fundamental structural change.

Catalysts here include individuals or institutions working on government regulations, developing technology innovations, or building community initiatives to drive an inclusive financial system.

Learn MoreStructural Policy Change examples

- Government agencies responsible for drafting legislation and policies to ensure access and inclusion to financial markets, products and services.

- Policies such as the adoption of rent reporting, which create new opportunities for people who were previously credit invisible to become scorable. In turn, these people have access to a new set of products and services.

- Consumer protection laws.

- Technology innovations that improve access and inclusion, such as platforms for online financial services.

- Coalitions and institutions that connect consumers to safe, affordable bank accounts and products.

- Nonprofit organizations and think tanks that spearhead initiatives and programs supporting financial access and inclusion into financial society.

How does public policy broadly improve access to financial education?

Structural Policy Changes within the Ecosystem act specifically upon access and inclusion within financial society, as financial inclusion is a necessary foundation for financial education.

However, access to financial education—in addition to access to financial products and services—is important. One of the best ways to accomplish this is by providing quality, effective financial education in high schools. Personal finance graduation requirements can provide access to financial education coursework, but care should be given to how these mandates are crafted and implemented. Without well-designed, well-funded mandates that are explicitly aimed at advancing equity and serving students with the highest needs, there is a risk that policies will continue to serve only students who are already well-advantaged.

From there, access and inclusion to financial services and products is what will allow individuals to act upon their financial knowledge and skill and widen their choice sets as they move into the Financial Actions and Outcomes cycle.

Behavior Influencer

Behavior influencers provide informational nudges, expert advice, guidance, financial coaching, counseling or therapy. They also create interventions designed to help an individual make decisions or cultivate certain behaviors. Their main goal is to influence behavior rather than check for knowledge, though deeper knowledge may build as a result.

Learn MoreBehavior Influencer examples

- In-the-moment information interventions provided at a point of purchase of decision-making, such as a quiz to select between different products on a company’s website.

- In-depth support like financial coaching or counseling.

- Expert financial advice or guidance, such as from Certified Financial Planners.

- Financial therapy, including psychoeducational groups.

- Peer mentorship.

- Nudges and choice architecture.

- Mobile apps and AI technologies that assist in cultivating specific financial behaviors.

Is there an overlap between Knowledge Influencers and Behavior Influencers?

Knowledge Influencers and Behavior Influencers are differentiated by intent. Behavior Influencers often employ interventions that try to influence behaviors rather than check for knowledge gain. As such, Behavior Influencers may influence knowledge and decision-making skills, even though that’s not their specific goal.

For example, a FinTech app might nudge an individual to develop a savings habit. While financial knowledge might increase as a byproduct of using the app, the app’s ultimate objective is to influence spending and saving choices.

Social and Material Supports

Social and Materials Supports aim to change the outcome an individual would otherwise experience in a specific situation. They often act as a safety net and can dampen the effect of financial shocks by providing direct assistance to meet basic needs, often through public benefits or community assistance programs.

Learn MoreSocial and Material Support examples:

- Unemployment insurance when someone loses a job.

- Public healthcare delivered through community-funded clinics.

- Food and nutrition services.

- Housing vouchers.

- Basic needs support for college students living on campus.

Research and Evaluation

Research and evaluation are woven throughout the Ecosystem, rather than constrained to a single part. Research examines how each element in the Ecosystem impacts financial well-being, the relationships among them, potential barriers to financial well-being, and other context-building data. Evaluation is a key part of validating the effectiveness of various interventions.

Learn MoreResearch and Evaluation examples

- Testing relationships and pathways throughout the Ecosystem to enhance understanding of how those relationships and pathways affect financial well-being.

- Investigating the effectiveness of various Catalysts for Change and other interventions.

- Examining and validating existing assessments, instruments, indices and metrics used to measure or quantify various elements of the Ecosystem for increased precision and effectiveness.

What are the Catalysts for Change for Foundational Factors?

The Personal Finance Ecosystem model includes Catalysts aimed at directly impacting financial well-being. While there are many interventions, organizations, and movements that focus on impacting the elements listed in Foundational Factors, their target outcomes are not typically financial in nature. While those Catalysts are crucial in indirectly impacting financial well-being, they currently are outside the scope of this framework.