Financial Education Innovation & Impact Summit

FEI&I Summit: Uniting experts, advocates, and educators in impactful conversations on financial education and wellness. Connect and learn in the Personal Finance Ecosystem.

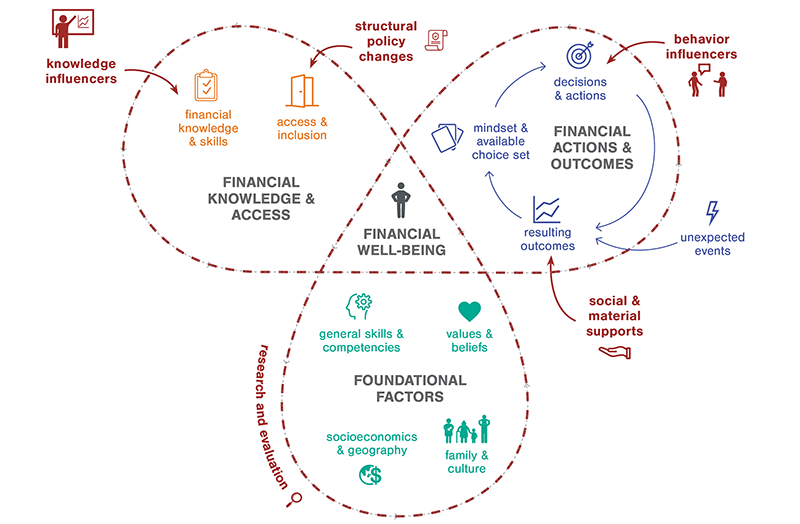

Financial education is one element in a complex, interrelated ecosystem that comprises a wide array of internal and external elements. This ecosystem framing helps convey the dynamics of influence and challenges the field to consider the various elements when designing research, interventions and success metrics.

FEI&I Summit: Uniting experts, advocates, and educators in impactful conversations on financial education and wellness. Connect and learn in the Personal Finance Ecosystem.

In early 2021, NEFE partnered with the Council for Economic Education (CEE) to host a series of five Financial Education Policy Convenings. The series of virtual events aimed to provide state policy makers a forum in which to discuss the opportunities, technicalities and challenges they encounter when considering statewide financial education policy and programming.

Financial education plays an important role in guiding individuals to achieve their financial goals and contribute to the economic well-being of society. While there are many factors to consider, NEFE has taken measures to improve evaluation studies—for both practitioners and researchers.

Achieve impactful financial education with trained educators, validated materials, timely instruction, relevant content, and evidence-based evaluations.

NEFE has developed and managed many successful programs and initiatives that helped different audiences improve their financial literacy and financial well-being. Throughout the years, these programs have been retired for strategic purposes, allowing us to concentrate on new ways to support the financial capability field.

NEFE no longer creates, produces, distributes financial education curricula for schools and other organizations.

NEFE’s most popular publication, addresses decisions young adults make during their college years. Parents, teachers and students consider this the go-to guide for making better decisions toward financial well-being.

This all-in-one guide addresses financial goal-setting, getting out of debt, using bank accounts and credit card, monitoring and controlling spending, and boosting savings and investments.

The effect of financial education programs depends on numerous aspects of instruction, curricula and rigor. As a guide for educators on how to identify and implement successful financial education, NEFE has outlined five key factors that all programs should utilize to maximize the effect of outcomes.