Decision-makers need a clear, objective snapshot of what is known, as well as what has already been accomplished or attempted in order to have the appropriate information to make the case for change and address the tough questions that will lead to improvements within communities.

States Are Taking the Lead

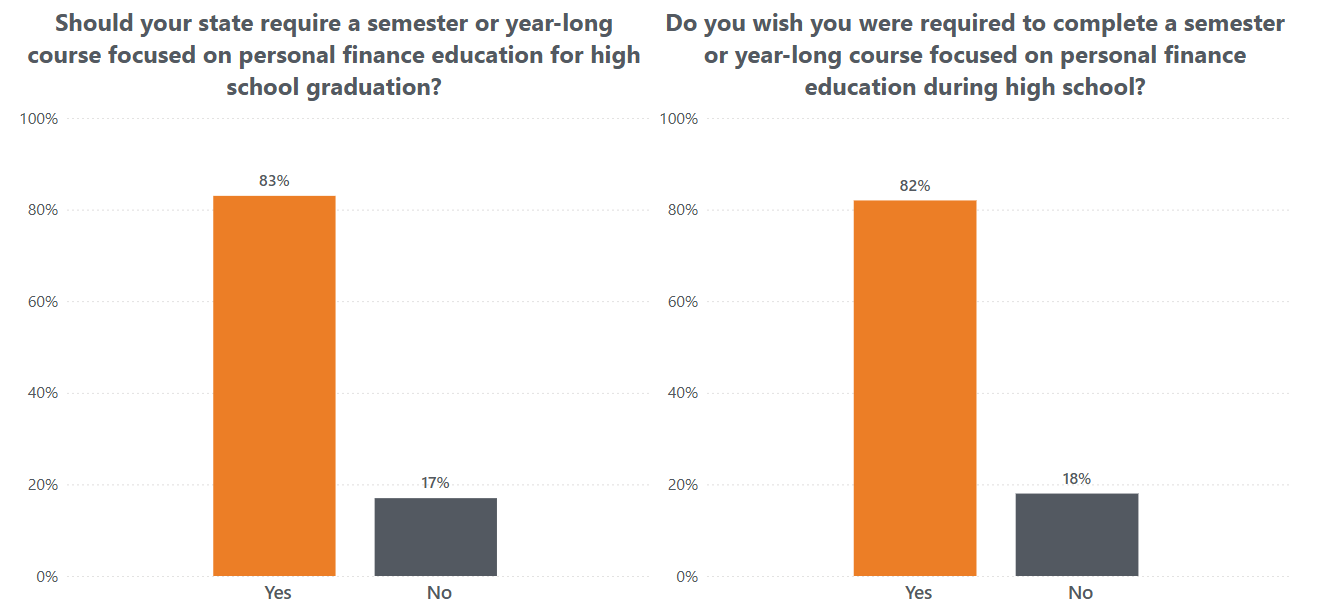

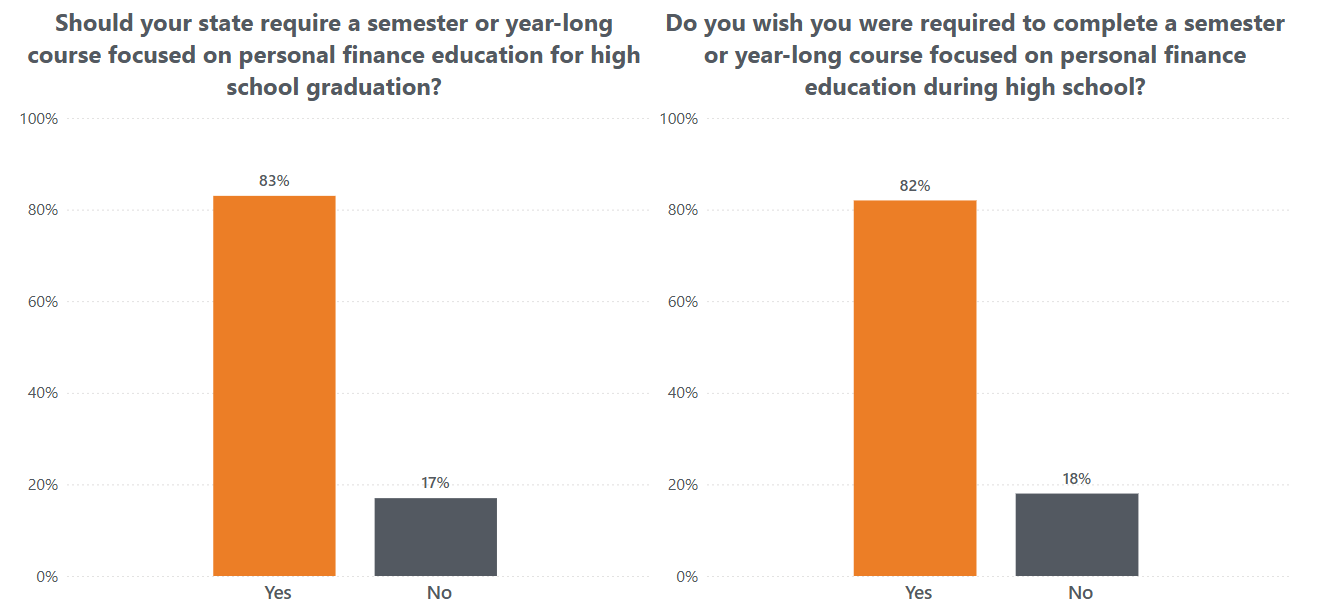

Financial education is supported by a majority of U.S. adults. According to nationwide opinion polling on the importance of financial education course requirements in high school, more than eight out of 10 U.S. adults feel personal finance education is important enough to be required for high school students to graduate. These adults make it abundantly clear that our next generation of citizens cannot fully flourish without considering how to enhance their financial lives.

- 83% of U.S. adults say their state should require a semester- or year-long course focused on personal finance as a graduation requirement.

- 82% of respondents who attended high school say they wish they were required to complete a personal finance class while they were in school.

Additional polling on which subjects U.S. adults believe students need to learn to prepare for life after graduation show that “Mathematics” and “Economics/Personal Finance” were the only subjects selected by at least 75% of respondents when asked to select their six ideal core subjects.

In the absence of a national strategy for financial education, there is significant momentum with individual states taking the lead in addressing youth course requirements. In 2024, a major milestone was achieved as more than half of U.S. states had officially enacted policies for course requirements for high school graduation. Not all states that have passed legislation have fully implemented their requirements. Yet, the list of states with requirements continues to grow.

Dive deeper into the benefits of high school financial education requirements.

Financial education is not a partisan issue

Strong support exists from both parties at the federal and state levels. In some states, the vote to approve graduation requirements was unanimous or had an overwhelming majority. Effective financial education has proven to be one of the few areas of agreement within the political spectrum.

We have been rallying for effective implementation for years. Among our focus:

State agencies have historically been powerful advocates in supporting financial education legislation, using the following general parameters:

- The policy must be well-designed, with consideration given to educators, resources, community make-up, budget, etc.

- Learning from and working with peers in other states who are also championing financial education.

- Advocating for comprehensive and accessible scholastic design that explores the basics of personal finance in addition to a deeper understanding of consumer protection, economic mobility, etc.

NEFE offers an annual review of legislative activities. Read our latest update.

Financial Education K-12 Policy Implementation Papers

We keep an eye on new policies that are changing people’s lives and providing insight and data on what needs to come from these policies.

The most pertinent policies concerning financial education are happening at the state level through legislation to install a graduation requirement. Passing legislation is the first step of the process. Once a requirement has been set in motion, states have many considerations to work through to make financial education effective and impactful. NEFE has published a series of papers to share best practices, learnings and recommendations from conversations with states at various stages of implementation.

Learn more about our work in policy and advocacy.

Data and Research Are Addressing Key Questions

Research has validated the benefits of financial education through well-scrutinized, vetted work. Some examples include:

Research has validated the benefits of financial education through well-scrutinized, vetted work. Some examples include:

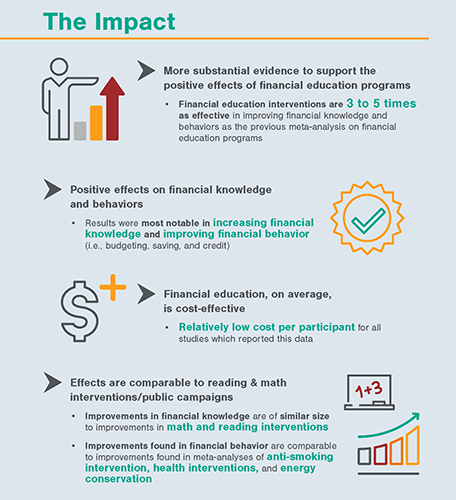

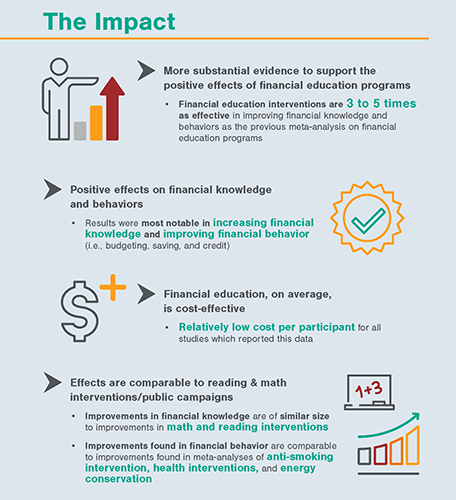

- Kaiser, et al, meta-analysis of 76 randomized experiments with a sample size of over 160,000:

- Shows financial education programs have positive effects on financial knowledge and downstream financial behaviors.

- Financial education is a cost-effective way to increase financial knowledge and improve a host of behaviors related to budgeting, saving, credit, insurance and more.

- NEFE developed infographics detailing the findings.

- A study through Montana State University, led by Dr. Carly Urban, finds that in states with personal finance graduation requirements, students:

- Make better decisions about how to pay for college.

- Increase applications for aid, federal aid taken and grants.

- Decrease credit card balances.

- Simply put, financial education leads to better borrowing decisions.

- Knology’s Financial Education Database and Fellowship:

- Examines the impact of spending on youth financial education using measures designed to capture the experiences and challenges of low- and moderate-income Americans.

- Open-access database of historical spending of financial education across all 50 states.

Additional work and resources:

These resources can be used as the foundation for initiating and defending the need for financial education—from schools to communities and beyond.

NEFE’s Role

As the field evolves and new questions arise, NEFE is committed to adapting as an independent, centralizing voice. We aim to provide those who are driving change with the information they need, when they need it. Here are resources we offer to those who want to create solutions:

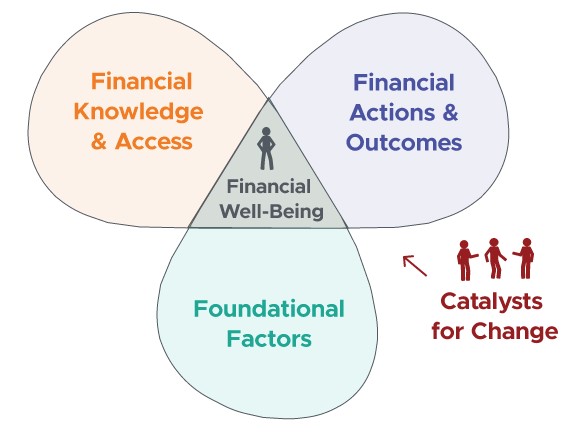

Personal Finance Ecosystem

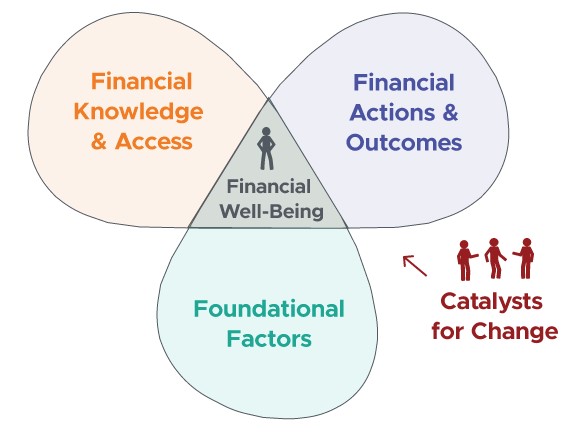

A single financial education solution that will work for all ages, communities and demographics on their path to attaining financial well-being does not exist. The Personal Finance Ecosystem outlines the factors that can contribute to financial well-being, such as income, employment, education, health, and family and social support. Different communities and regions emphasize different factors, so solutions should be crafted with the target audience in mind, underscoring both the individual contributions to inclusion and well-being.

A single financial education solution that will work for all ages, communities and demographics on their path to attaining financial well-being does not exist. The Personal Finance Ecosystem outlines the factors that can contribute to financial well-being, such as income, employment, education, health, and family and social support. Different communities and regions emphasize different factors, so solutions should be crafted with the target audience in mind, underscoring both the individual contributions to inclusion and well-being.

Learn more about the Personal Finance Ecosystem.

Five Key Factors for Effective Financial Education

NEFE believes a shared national definition of effective financial education must include the following:

- Well-trained financial educator (and/or tested financial e-learning protocol)

- Vetted/evaluated financial education program materials

- Timely personal finance instruction

- Relevant subject matter

- Evaluating impact

Learn specifics of each of these factors here.

Our Research Priorities

Since 2006, NEFE has funded over 50 projects, allocating more than $7 million, to address specific gaps in information for rigorous, innovative and actionable research that increases the field’s body of knowledge, provides insight into financial behavior and contributes to a better understanding of effective educational practices. These projects can help provide direction and validation for specific aspects of financial education work.

NEFE’s research opportunities provide funding for projects that address:

-

- Measurement

- Systemic inequality

- Data and methodological limitations

- Youth focus

Learn more about these priorities and the projects we have funded.

National Polling Data

High-quality polling on how the general public and specific demographics view key financial education and financial well-being issues is an important tool to use when supporting change. This data can be used in policy development and identify ways to direct resources.

NEFE has collected data on how U.S. adults feel about the need for financial education in schools, feelings on their personal financial well-being, views on important policy changes (e.g. student loans), financial inclusion and other important topics.

Learn more about all the polls we have fielded.

Financial Education: Progress and Priorities

Financial Education: Progress and Priorities

In Financial Education: Progress and Possibilities, NEFE explores financial education initiatives in historical context and how they have grown in importance for individuals, families and society throughout the U.S.

Research has validated the benefits of financial education through well-scrutinized, vetted work. Some examples include:

Research has validated the benefits of financial education through well-scrutinized, vetted work. Some examples include: A single financial education solution that will work for all ages, communities and demographics on their path to attaining financial well-being does not exist. The Personal Finance Ecosystem outlines the factors that can contribute to financial well-being, such as income, employment, education, health, and family and social support. Different communities and regions emphasize different factors, so solutions should be crafted with the target audience in mind, underscoring both the individual contributions to inclusion and well-being.

A single financial education solution that will work for all ages, communities and demographics on their path to attaining financial well-being does not exist. The Personal Finance Ecosystem outlines the factors that can contribute to financial well-being, such as income, employment, education, health, and family and social support. Different communities and regions emphasize different factors, so solutions should be crafted with the target audience in mind, underscoring both the individual contributions to inclusion and well-being.