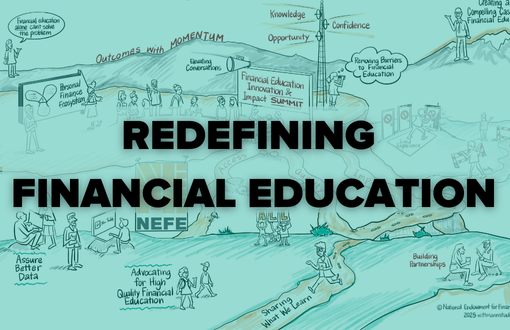

Our goal is simple: to better understand the financial ecosystem and improve it

NEFE believes that effective financial education that is equitable and accessible to all makes it easier for everyone to navigate the financial landscape, as modeled in the Personal Finance Ecosystem, our framework that underpins financial well-being.

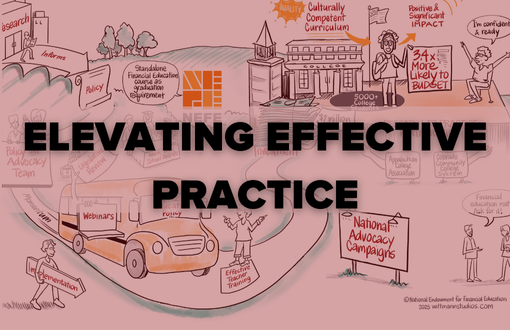

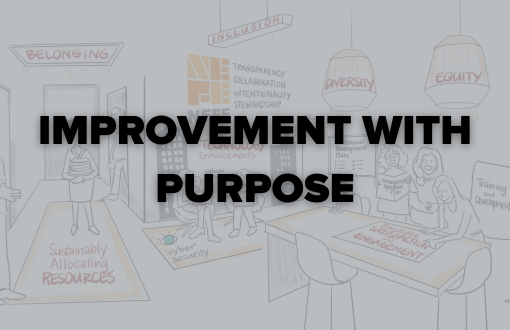

The 2019-2024 Strategic Plan: Impact for Financial Education, served as a foundational pivot for the organization to deepen our impact, effect wide-spread change and work to create a more just society.

Explore the narrative of NEFE's five strategic plan goals through illustration, initiative highlights, performance metrics and a summary of efforts expected to continue as NEFE plans for the future and remains committed to maximizing the impact of financial education.