Introduction

Stanford University’s Mind Over Money program brings an intentional, research-informed approach to student financial wellness. Director Kelly Takahashi and Associate Director Angela Amarillas lead this program with support from Charles Schwab Foundation. Takahashi and Amarillas have done extensive work developing a theory of change to help better measure Mind Over Money’s impact. They worked hard to clarify how the program’s activities lead to their desired impact – equipping students with knowledge, skills, confidence and motivation to increase healthy financial behaviors.

The National Endowment for Financial Education (NEFE) spoke with the Mind Over Money team to learn more about their work and how the Personal Finance Ecosystem helped contextualize their efforts. This case study details their experience developing a theory of change so that other educators and practitioners can learn from their work.

Mind Over Money Overview

Mind over Money’s vision is “to operate a best-in-class program on the Stanford campus that increases all students’ financial wellness with impactful, relevant, and research-informed programming and resources.” They do this by offering online resources, workshops, one-on-one financial coaching and an academic course, Financial Wellness for a Healthy, Long Life. Early in the program’s creation, they connected with Charles Schwab Foundation which provided start-up funding and expert guidance on financial education. This partnership’s intention was that Mind Over Money would eventually share its model and findings with the larger financial education community to help further collective efforts.

Theory of Change

A theory of change provides a roadmap for desired change. It is a tool used to identify long-term goals and then maps backward to identify necessary activities and mechanisms. Developing a theory of change can clarify overall strategy and ensure that efforts align with desired outcomes and impact.

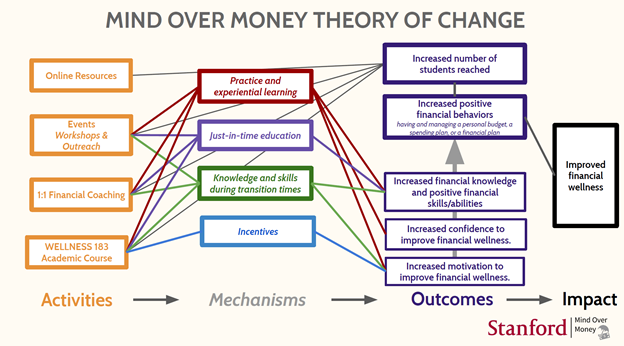

The Stanford team developed a theory of change for Mind Over Money to codify their efforts and better evaluate their impact. Takahashi and Amarillas described their theory of change as a constant work in progress that evolves as they learn more. They want to ensure that the activities facilitated by Mind Over Money align with their desired impact.

Based on the Consumer Financial Protection Bureau’s definition of financial well-being, Mind Over Money set its ultimate target impact as financial wellness for students. From there, they listed current activities and desired outcomes. Takahashi and Amarillas used these lists to link activities and outcomes to student financial wellness outcomes. This exercise led them to emphasize activities that were most connected to behavior change while positioning knowledge as one of several supportive mechanisms.

“The process of linking activities with outcomes really caused us to check our assumptions, which can be a vulnerable thing to do, but ultimately really powerful,” Amarillas explained. “With limited time and resources, we wanted to make sure our efforts were achieving our intended outcome.”

Takahashi added, “The theory of change has been a helpful touchstone for us when we are considering something new. It helps us make a decision and target our time and resources toward the activities most impactful for behavior change.”

NEFE’s Personal Finance Ecosystem

The Stanford team connected with NEFE after learning about the Personal Finance Ecosystem framework. The concept resonated with them as the Personal Finance Ecosystem maps out which influencers impact what outcomes. For instance, the Personal Finance Ecosystem illustrates that knowledge influencers, such as financial education and financial information, impact knowledge and the skill to decide or act. Knowledge influencers alone do not impact behavior change. Behavior influencers, such as coaching or nudges, are needed to influence actual behavior change.

Mind Over Money’s theory of change articulates this distinction by linking knowledge activities to knowledge outcomes, while behavior influencers are linked to behavior change outcomes. While both knowledge and behavior influencers are needed to achieve financial wellness, it is common to see only knowledge influencers linked to behavior change in financial education programs. Amarillas and Takahashi found that the Personal Finance Ecosystem framework helped contextualize and validate their work.

“The Personal Finance Ecosystem just felt so familiar with what we have done and what we want to do,” Amarillas said. “It put into one document something that’s very complicated. Rightsizing expectations was helpful for us to recognize that we can’t do everything and that we need to work collaboratively as an ecosystem to drive change.”

Going Forward

Takahashi and Amarillas stress that they will continue to tweak their theory of change as they learn new data about effective financial education. They are committed to sharing their work and findings with other financial educators. They strive to use the Mind Over Money program to foster a community culture of healthy financial behaviors in and around Stanford University. Their work can be followed at the Mind Over Money webpage.

For guidance on developing a theory of change, the Annie E. Casey Foundation provides this helpful free resource.

About NEFE Case Studies

NEFE highlights quality financial education programs to provide ideas, guidance and inspiration for financial educators and practitioners.