DENVER—The National Endowment for Financial Education® (NEFE®) has introduced advancements to its Personal Finance Ecosystem (Ecosystem), a research-informed framework to help practitioners, researchers and policymakers understand the many factors that comprise and influence an individual’s financial well-being, as well as see where their work fits into a larger context. This update will serve as the foundation for short-term and long-term research and NEFE’s ongoing thought leadership endeavors.

“The Ecosystem is based on NEFE’s distinguished history and expertise in financial education and encompasses all the work happening across the financial well-being field, whether from research, practice, policy or direct service. This resource intends to add clarity and collaboration to our ever-evolving field,” says Billy Hensley, Ph.D., president and CEO of NEFE. “This updated version of the Ecosystem takes a realistic look at the many forces at play in how individuals experience varying levels of financial well-being throughout their lives. This is a useful tool for those in diverse disciplines and concentrations of financial education.”

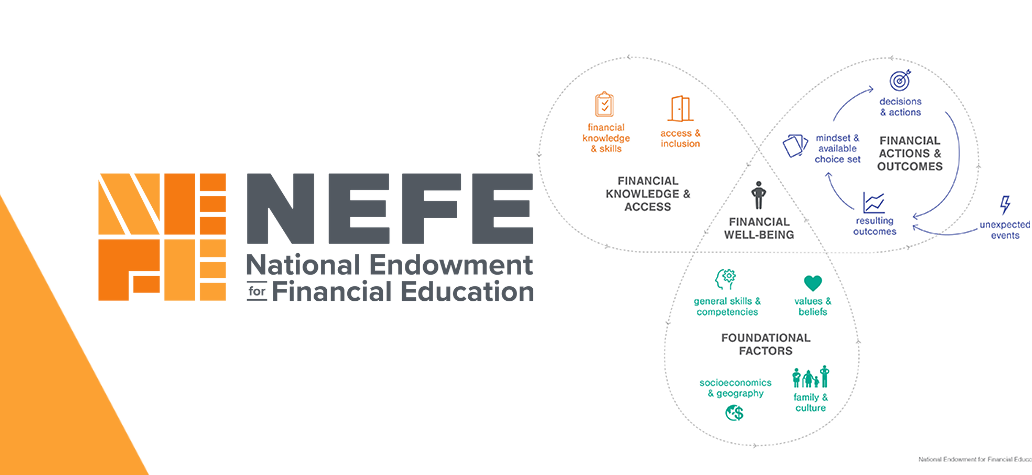

The Ecosystem, now in its third iteration, provides important updates to the original framework. Most notably, the new design moves away from a pyramid shape topped by financial well-being, which incorrectly implies hierarchy and financial well-being as an end state. In the updated design, financial well-being is centered as an ever-present, fluid and fluctuating state influenced by the interplay of many factors that can broadly be divided into three areas: foundational factors, financial knowledge and access, and financial actions and outcomes.

Other updates include the addition of core elements such as mindset and choice set; the visual representation of economic inequalities and cultural factors within foundational factors; and the revision of language to be more inclusive and intuitive to those outside of the financial education field. The new version also elevates the importance of structural policy changes and social and material supports as leverage points acting upon the Ecosystem.

“This updated version reflects emerging information and evolving trends, while incorporating thoughtful feedback from the financial education community. However, we still consider this a ‘living resource’ and will continue to hone the material to be inclusive and responsive to the evolving realities of individuals and our field,” says Beth Bean, Ph.D., NEFE’s Research and Impact senior vice president.

NEFE introduced the first iteration of the Ecosystem in 2019 to lay out the foundations that underpin an individual’s state of financial well-being and right-size expectations for what interventions targeting financial well-being realistically can achieve. A second version was produced after receiving feedback from the financial education community and quickly became viewed as a valuable, practical resource for many organizations and researchers.

The newest update of the Ecosystem will complement other initiatives NEFE will undertake this year in the form of funded research, presentations and other projects.

“This new release of the Ecosystem comes at an important time. NEFE is celebrating its 30th year of operations in 2022 and it’s fitting that the Ecosystem is refreshed as we launch our next phase of working to improve equitable access to financial education in our country,” Hensley adds.

Learn more about the Personal Financial Ecosystem.