Thirty-six percent (36%) of American working adults could not cover an unexpected $2,000 expense within 30 days. That means a single medical bill or car repair can trigger a chain of financial losses: More debt damages credit, leading to worse loan terms. Medical conditions go untreated, limiting the ability to work. Lack of assets such as insurance, credit cards and retirement accounts mean higher spending, more fees and interest, and less future security.

A broad cross-section of Americans of all ages and incomes are financially fragile, but middle-aged and middle-income families are surprisingly vulnerable. New research shows higher financial literacy helps offset everyone’s risk.

What Is Financial Fragility?

A new study from the Global Financial Literacy Excellence Center (GFLEC) at The George Washington University defines financial fragility as the inability to cope with an immediate $400 emergency expense or being unable to come up with $2,000 in 30 days.

The study analyzes data from two nationally representative data sets — the 2015 National Financial Capability Study (NFCS) and the 2015 Survey of Household Economics and Decisionmaking (SHED).

The NFCS data show that 36 percent of respondents “probably could not” or “certainly could not” come up with $2,000 if an unexpected need arose in the next month.

The SHED data reveal that 41 percent could not cover an immediate expense of $400.

The researchers focused on individuals who are in their prime working years (ages 25 – 60) and not retired. People outside this age range are more likely to have different characteristics, needs and financial behaviors. People under 25 may be students with no labor income, while those over 60 may be retired and receiving Social Security benefits.

Who is Financially Fragile?

During the Great Recession, nearly 50 percent of working-age adults were considered financially fragile. Although the U.S. economy has recovered steadily over the past 10 years, household financial fragility remains high at 36 percent.

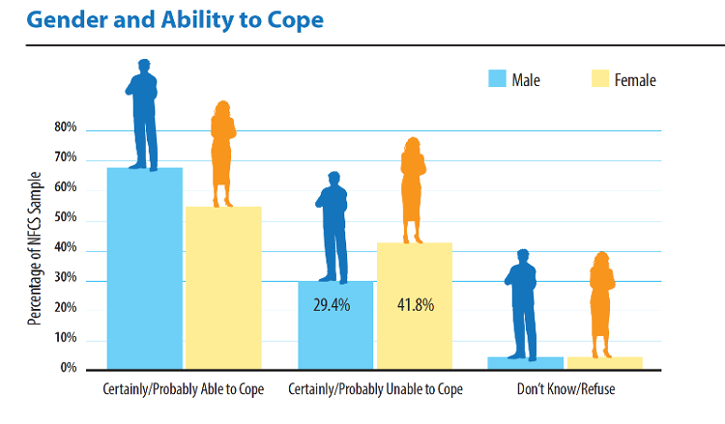

Women are significantly more likely to be fragile than men.

- 42 percent of women versus 29 percent of men are financially fragile.

- Women in the 40- to 44-year-old age group are more likely to be financially fragile than 25- to 29- year-old women.

- Marriage makes women less likely to be financially fragile, while there is no significant effect for men.

- Employment of any kind makes women less likely to be financially fragile.

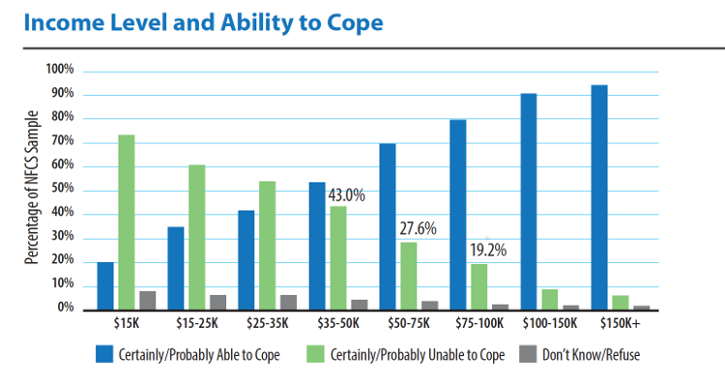

Financial fragility decreases steadily with increasing income.

- Households with annual incomes in the $35 - 50,000 range (43 percent) are far more likely to be financially fragile than those earning $50 - 75,000 (28 percent).

- Almost 30 percent of middle-income households ($50 - 75,000) and 20 percent of high-income households ($75 - 100,000) are financially fragile.

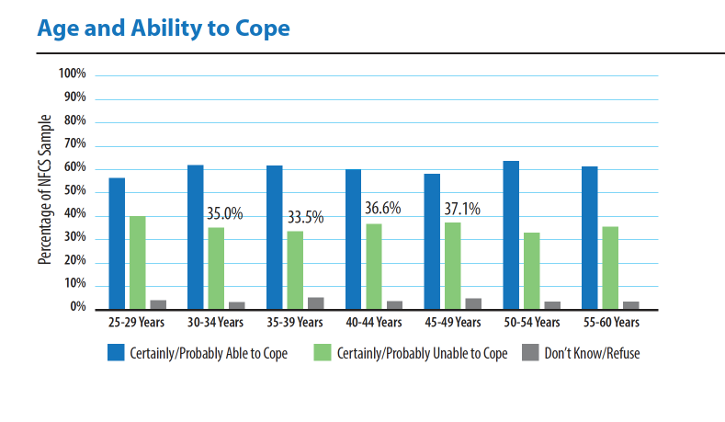

Financial fragility is nearly equally distributed across age groups, although fragility is slightly higher in the middle age group of 40- to 49-year-olds.

- Financial fragility is comparable across all age groups, despite the perception that older people have more assets and wealth.

- The 40 - 49 age group is more fragile than the 30 - 39 group, possibly due to a spike in financial obligations such as child care costs, student loan repayments and mortgage payments in this life stage.

Other Factors

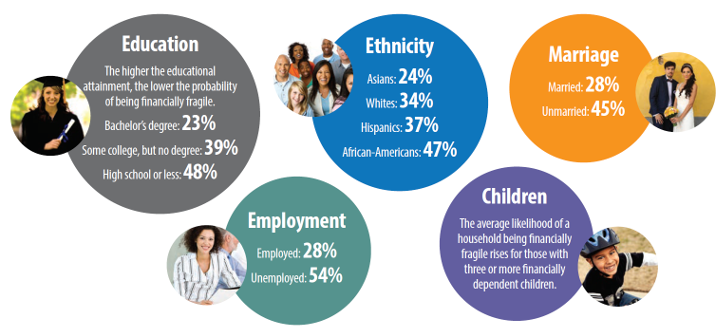

Percentages of financial fragility by other factors:

“I can make it through the month if nothing goes wrong.” — Focus group participant

In addition to data analysis, researchers conducted focus groups in Baltimore, Cincinnati and Austin. Participants confirmed that “fragile” is a good description of their financial state. Sometimes an unexpected expense as small as a parking ticket can trigger a chain of financial losses and setbacks.

Faced with an expense they can’t afford, these families might use one of these coping mechanisms:

- Work more

- Use alternative financial services (payday lenders, pawnshops, check cashing services)

- Sell something or cash in assets

What Causes Fragility?

Lack of Assets

Financially fragile households tend to lack assets that nonfragile households take for granted.

House: Renting means no equity is being gained. And the family is at the mercy of the rental market.

Car: Reliable transportation is crucial to getting and keeping a job, as well as doing daily activities such as grocery shopping and doctor appointments.

Insurance: Inadequate health insurance means higher out-of-pocket costs. Lack of car and home insurance can mean huge bills for repairs and maintenance.

Bank Accounts: Lack of access to traditional financial products can lead to use of services that charge higher interest, fees and penalties.

Retirement Accounts: Without a 401(k) or IRA in which to grow it, cash that could have been invested loses buying power, thanks to inflation. Those who are financially fragile are almost 18 percentage points less likely to plan for retirement.

Credit Cards: Low borrowing capacity means fewer options to pay for large unexpected expenses. There is no credit safety net.

Debt

Medical Debt makes respondents more likely to be financially fragile.

Education Debt: Almost 50 percent of those with education debt have difficulty dealing with a $400 emergency expense, versus 39 percent of those without education debt.

Credit Card Debt: Financially fragile respondents tend to have limited access to credit. They are more likely to be denied credit or to receive less than they ask for.

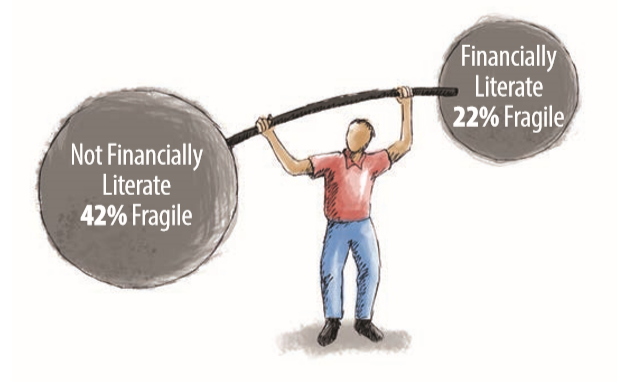

Financial Literacy is an Answer

The data are clear: Financial literacy lowers the likelihood of individuals being financially fragile significantly. This finding is consistent across all age categories and even when controlling for overall educational attainment. That means whether you are young or old, whether you have a high school diploma or a Ph.D., higher financial literacy means you are less likely to be fragile.

- Financial literacy seems to be highly beneficial for women, decreasing their chances of being financially fragile at higher rates than for men.

- Regardless of education levels, financially literate respondents are more likely to plan for retirement.

- Financial literacy has the greatest positive impact on those with the least education, decreasing the likelihood of fragility by nearly 7 percentage points for those in the lowest education category.

About the Study

Based on Financial Fragility in the U.S.: Evidence and Implications by Raveesha Gupta, M.A., Andrea Hasler, Ph.D., Annamaria Lusardi, Ph.D., and Noemi Oggero, M.Sc., at the Global Financial Literacy Excellence Center, The George Washington University School of Business.