People of Color, Renters Disproportionately Affected

DENVER—Nearly seven in 10 U.S. adults (68 percent) say they experienced unexpected financial setbacks in 2020, according to a survey on consumer views about finances released by the National Endowment for Financial Education® (NEFE®). Not surprisingly, given the COVID-19 pandemic and impacts on the economy, the top setbacks were job loss and inability to keep up with debt/falling behind on bill payments (both 24 percent).

The survey finds Hispanic Americans (78 percent) and Black/non-Hispanic Americans (76 percent) were more likely to have experienced unexpected major expenses or financial setbacks in 2020 than white/non-Hispanic Americans (63 percent).

“The data provide more evidence of societal inequities for vulnerable populations. The effects of the pandemic on the nation’s economy are shouldered by those who can least afford it,” says Billy Hensley, Ph.D., president and CEO of NEFE. “These findings will help the financial education community better collaborate and focus our efforts for maximum impact as we help individuals and families get back on their feet in 2021.”

The survey was conducted online by The Harris Poll on behalf of NEFE among more than 2,000 U.S. adults.

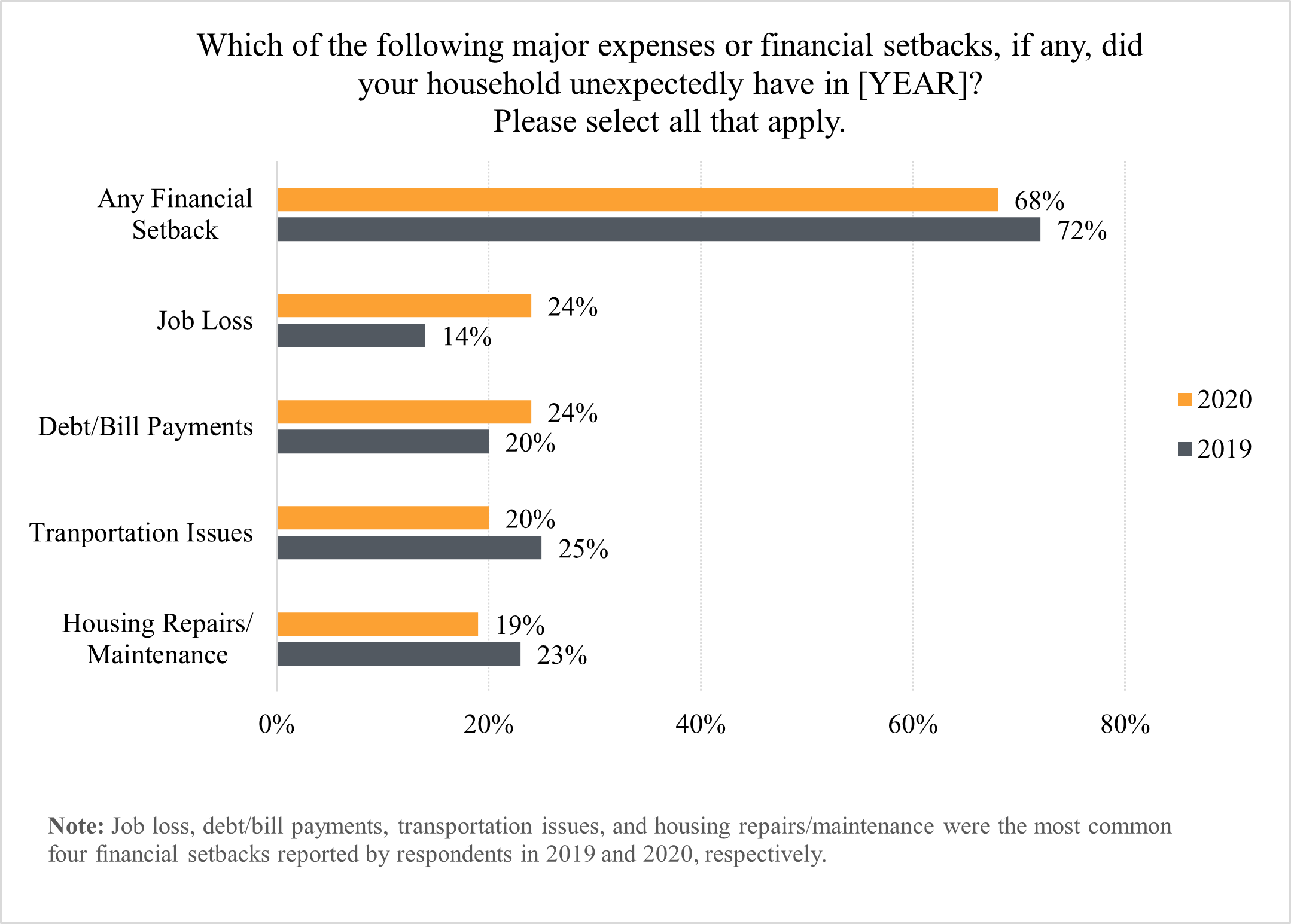

Unexpected Financial Setbacks

The percentage of adults who experienced unexpected major expenses or financial setbacks was slightly lower in 2020 (68 percent) than in 2019 (72 percent), but the nature of the setbacks is markedly different this year. Job loss and the inability to keep up with debt/falling behind on bill payments (both 24 percent) topped the 2020 list, whereas transportation issues (25 percent) and housing repairs/maintenance (23 percent) topped the 2019 list.

In 2020, women (28 percent) were significantly more likely than men (20 percent) to say they could not keep up with debt or were falling behind on bill payments. Renters (36 percent) were significantly more likely than homeowners (19 percent) to say they could not keep up with debt or were falling behind on bill payments.

Hispanic Americans (37 percent) and Black/non-Hispanic Americans (29 percent) were more likely than white/non-Hispanic Americans (21 percent) to have experienced job loss in 2020. Renters (34 percent) were significantly more likely than homeowners (21 percent) to have experienced job loss as well.

“Although racial and gender inequities in financial matters tend to be quite obvious, the effects of COVID-19 have revealed the precarious situation of many of the nation’s renters,” says Hensley. “Some estimates predict that 30 to 40 million people in America could be at risk of eviction because of this crisis. That is a staggering number of Americans who are at risk.”

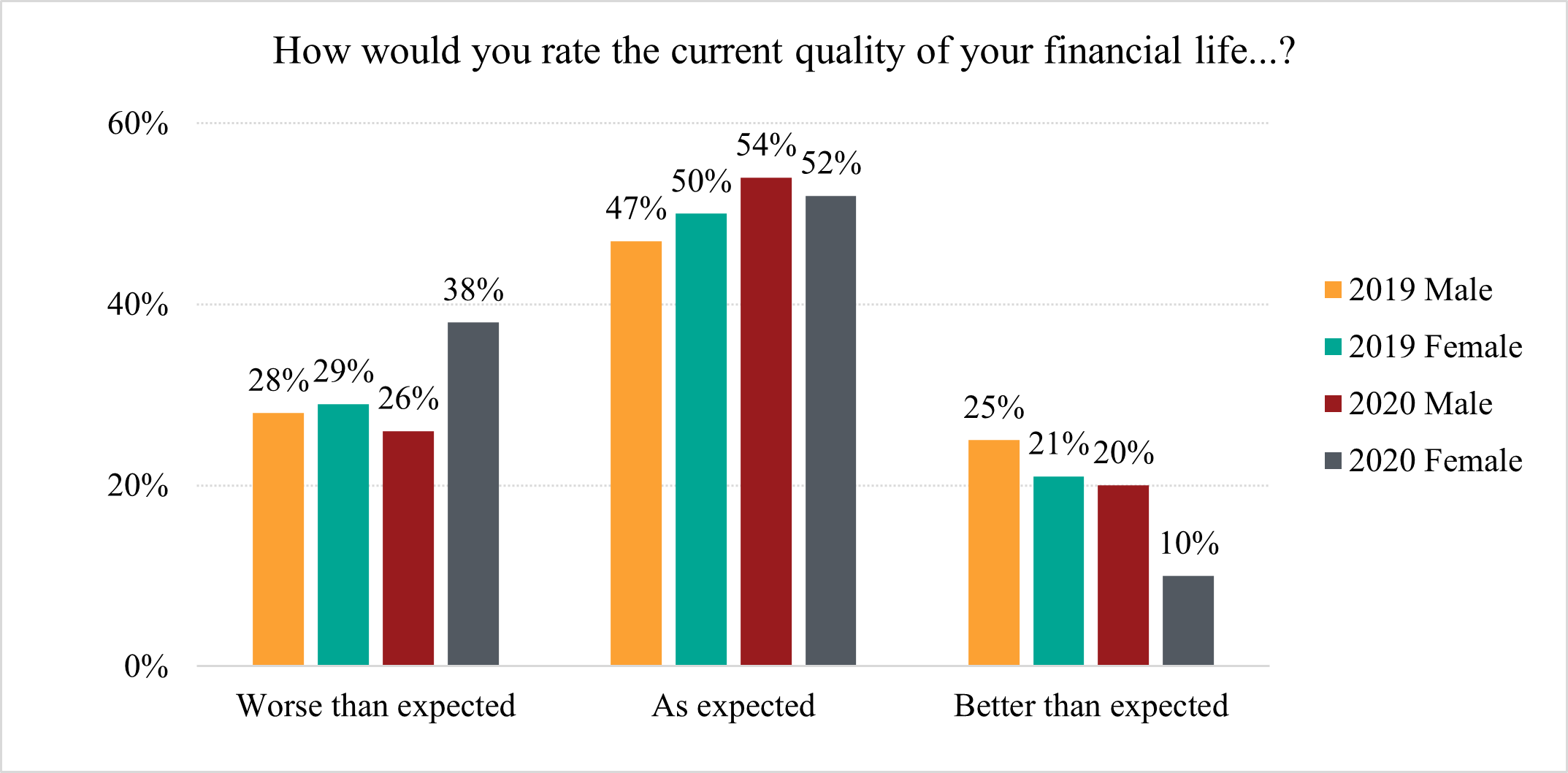

Quality of Financial Life

Nearly one third of U.S. adults (32 percent) say the current quality of their financial life is worse than they expected it to be, while about half (53 percent) say it is about what they expected it to be, and only 15 percent say it is better than they expected it to be. Overall, this reflects a decline in sentiment from 2019, when 28 percent felt their financial life was worse than they expected, 49 percent felt it was about the same, and 23 percent felt it was better than they expected.

Women (38 percent) are significantly more likely than men (26 percent) to say the current quality of their financial life is worse than they expected it to be. Hispanic Americans (43 percent) and Black/non-Hispanic Americans (37 percent) are far more likely than white/non-Hispanic Americans (28 percent) to say their financial life is worse than they expected it to be, as are renters (39 percent) compared to homeowners (29 percent).

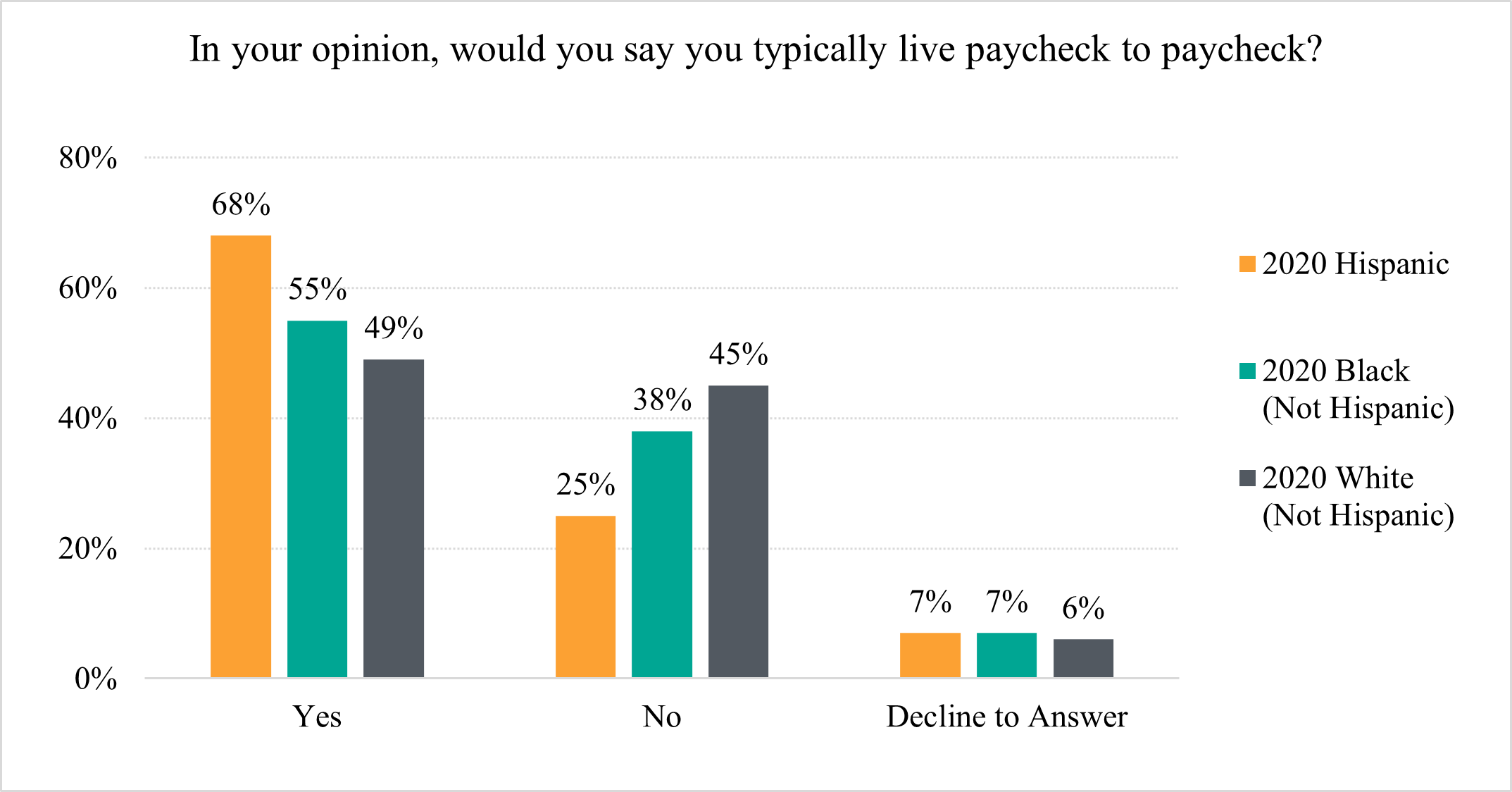

Living Paycheck to Paycheck

Overall, more than half (52 percent) of U.S. adults say they are typically living paycheck to paycheck, while 41 percent say they are not. The 2019 findings were similar: 53 percent said they typically lived paycheck to paycheck and 43 percent said they did not.

Renters (69 percent) are more likely than homeowners (46 percent) to say they typically live paycheck to paycheck. Hispanic Americans (68 percent) are significantly more likely than Black/non-Hispanic Americans (55 percent) and white/non-Hispanic Americans (49 percent) to say they typically live paycheck to paycheck.

Read more about the NEFE survey.

Survey Methodology

This survey was conducted online within the U.S. by The Harris Poll on behalf of the National Endowment for Financial Education between December 10-14, 2020, among 2,064 adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Please contact NEFE for complete survey methodology, including weighting variables.

1Aspen Institute (www.aspeninstitute.org) (August 2020) The COVID-19 Eviction Crisis: An Estimated 30-40 Million People in America Are at Risk.