Men More Likely Than Women to Confess to Deception

DENVER—A poll from the National Endowment for Financial Education® (NEFE®) analyzing financial infidelity among U.S. adults finds that among those who report having ever combined finances in a relationship, two in five (43 percent) confess to having ever committed some act of financial deception, with 85 percent of those individuals stating the indiscretion affected the current/past relationship in some way.

“When you comingle finances in a relationship, you’re consenting to cooperation and transparency in your money management. Regardless of the severity of the act, financial infidelity can cause tremendous strain on couples—it leads to arguments, a breakdown of trust, and in some cases, separation or even divorce,” says Billy Hensley, Ph.D., president and CEO of NEFE.

Financial infidelity is an act of deception by one partner in a relationship where finances are combined. Examples of infidelity include hiding purchases, money or accounts, lying about the amount of income earned, debt owed and more. The poll asked respondents about the incidence of financial deceptions in current/past relationships, as well as explanations for–and impacts of–those deceptions. NEFE’s poll analysis includes a breakdown of results by gender, race, employment status and other variables.

“NEFE’s polling provides a snapshot of issues that stand out in Americans’ consciousness when thinking about their finances. When two in five people admit to committing financial infidelity in a relationship where money is combined, it highlights the need for greater communication and a deeper understanding of who your partner is financially," Hensley adds.

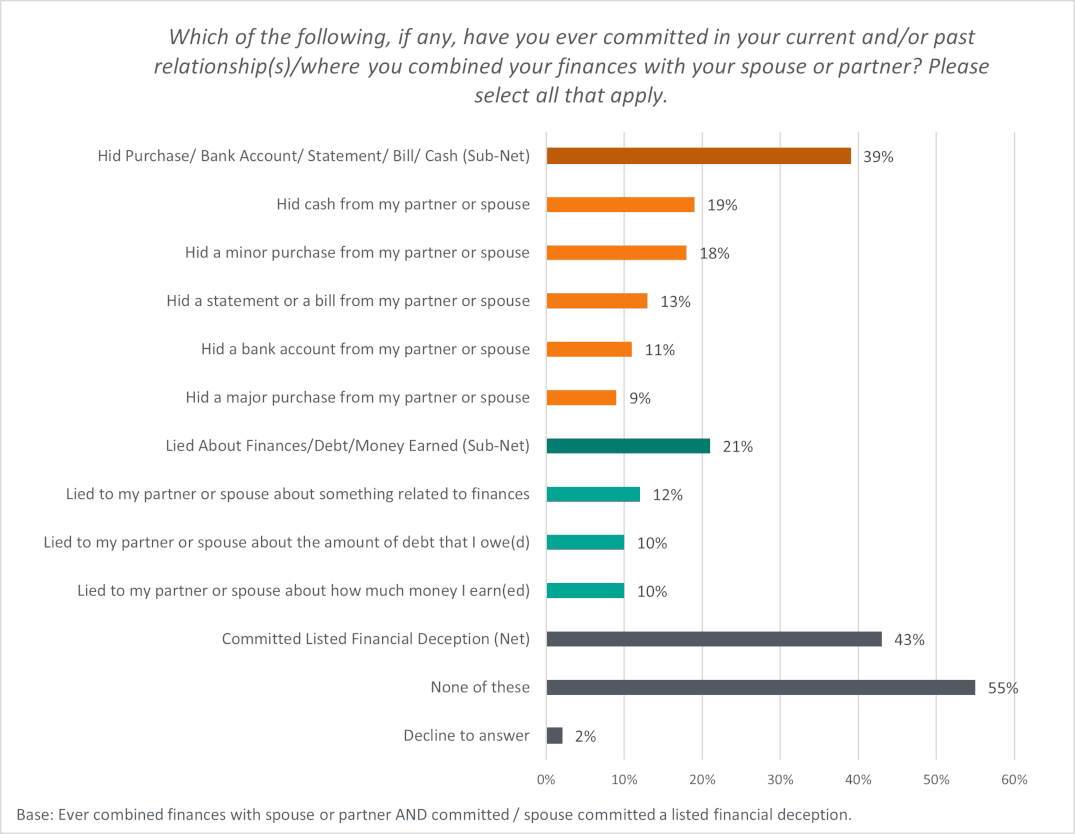

Among U.S. adults who have ever combined finances in a current/past relationship, 43 percent have ever committed at least one financial deception. Over one third (39 percent) admitted to hiding a purchase, bank account, statement, bill or cash from their partner/spouse, and about one in five (21 percent) admitted to lying about finances, amount of debt owed or amount of money earned to a partner/spouse.

The survey, which was conducted by The Harris Poll among 2,073 U.S. adults in June 2021 on behalf of NEFE, also finds that among those who ever combined finances with a partner:

- Men were more likely than women (47 percent vs. 39 percent) to report having committed a financial deception.

- Neither current income level nor current homeownership status appear related to whether financial deceptions were reported.1

- Current life situations may be related to reporting financial deceptions. Employed individuals (52 percent vs. 31 percent not employed) and households with children under 18 (59 percent vs. 32 percent without) both are significantly more likely to report a financial deception.2

- Two in five (42 percent) reported that a spouse/partner committed a listed financial deception on them.

1Note that the poll asks whether respondents have ever committed a financial deception, which refers to the past and present. Meanwhile, respondent income and homeownership data are current. If the reported financial deceptions occurred at respondents’ current income levels and homeownership statuses, then a relationship could be sought between those factors. However, because we cannot be sure when the reported financial deceptions occurred, these results should be interpreted as suggestive but not conclusive of whether a relationship exists between these factors and financial deception.

2Note that the poll asks whether respondents have ever committed a financial deception, which refers to the past and present. Meanwhile, respondent employment and presence of children in the household data are current. If the reported financial deceptions occurred at respondents’ current employment and presence of children in the household statuses, then a relationship could be sought between those factors. However, because we cannot be sure when the reported financial deceptions occurred, these results should be interpreted as suggestive but not conclusive of whether a relationship exists between these factors and financial deception.

“Our goal with this consumer poll is to understand whether or not financial infidelity occurs, why partners commit acts of financial deception, and the aftereffects,” says Jill Jones, Ph.D., NEFE managing director of research.

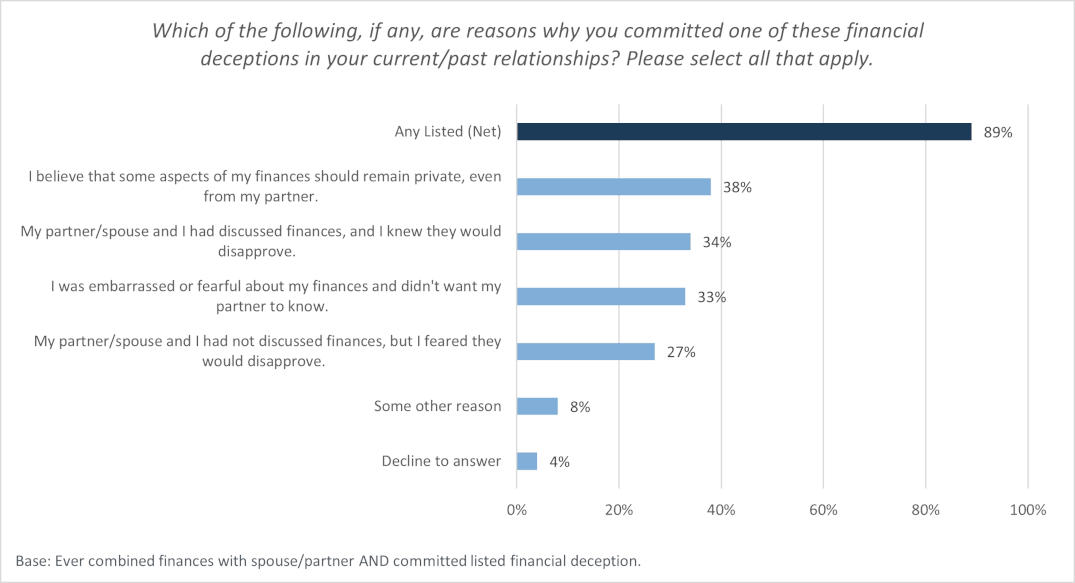

Reasons for Committing Financial Deception

When asked for reasons why they had committed a financial deception, U.S. adults who reported ever combining finances with a spouse or partner and committing a listed financial deception most often said that they believe some aspects of finances should remain private (38 percent). This was followed by fearing disapproval by a partner/spouse in a relationship where discussions of finances had already occurred (34 percent), being embarrassed or fearful about their finances (33 percent) and fearing disapproval by a partner/spouse in a relationship where discussions about finances had not yet occurred (27 percent).

Among those who ever combined finances with a spouse or partner and committed a listed financial deception:

- Among those in different income levels (“<$50K”, “$50-$74.9K”, $75K-$99.9K” and “$100K+”), there were few statistical differences among the reasons why they committed financial infidelity.

- The top reason among homeowners for having committed a financial deception was believing that some aspects of their finances should remain private (42 percent), while renters reported embarrassment/fear about their finances and not wanting their partner to know as their top reason (37 percent).

- The employed (43 percent) are more likely than the unemployed (27 percent) to justify their financial deceptions because of a belief that some aspects of their finances should remain private. The employed (31 percent) are also more likely than the unemployed (18 percent) to justify their financial deceptions because of fears of disapproval without having discussed finances with their partner/spouse.

- Those who are currently not married were significantly more likely to cite embarrassment as their reason for the deception, compared to those who are currently married (39 percent vs. 28 percent).3

- Those of Hispanic origin (41 percent) and Black (non-Hispanic origin) Americans (44 percent) are more likely than White (non-Hispanic origin) Americans (28 percent) to say embarrassment/fear about their finances and not wanting their partner to know led them to commit a deception.

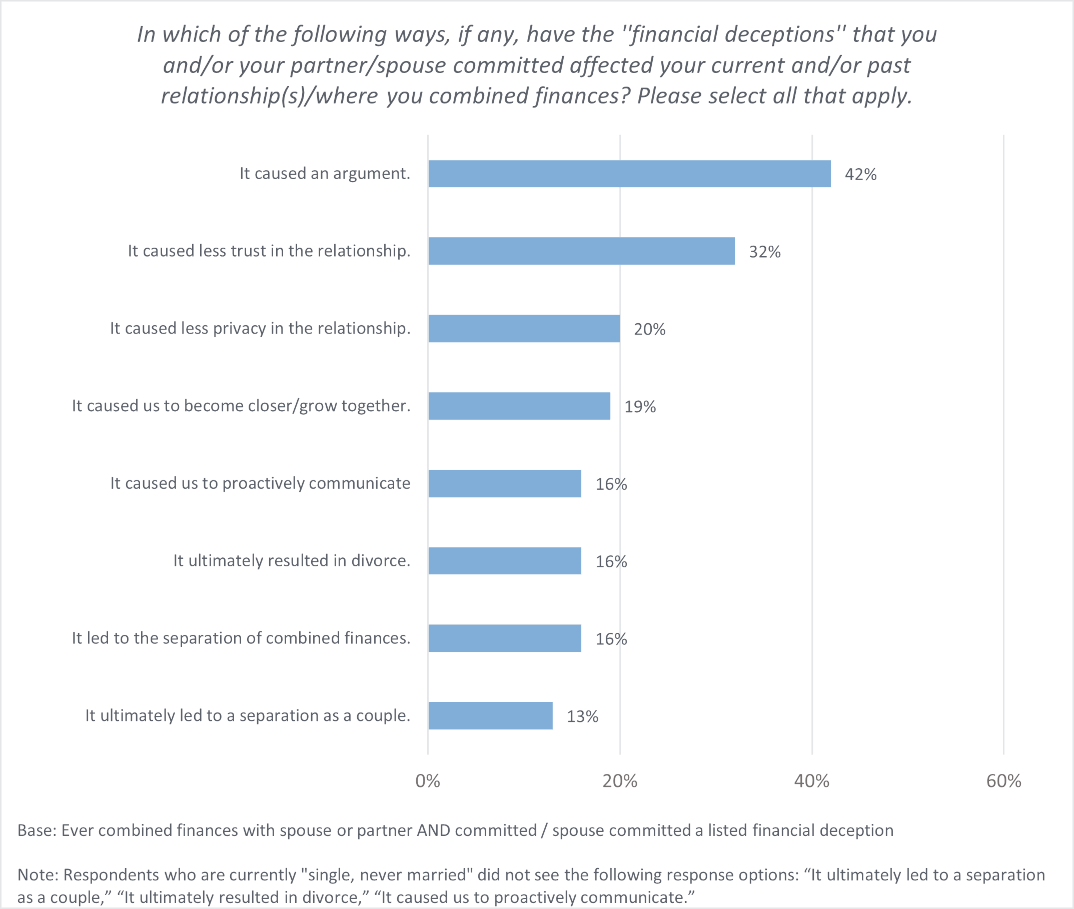

Effects of Financial Deception

More than eight in 10 (85 percent) U.S. adults who report ever combining finances with a spouse or partner and either committing a financial deception or their partner/spouse committing a financial deception indicate that financial deceptions have affected their current/past relationships where finances were combined. The outcomes include causing an argument (42 percent), less trust in the relationship (32 percent), less privacy in the relationship (20 percent), and leading to a separation of combined finances or divorce (16 percent each).4

3Note that the poll asks whether respondents have ever committed a financial deception, which refers to the past and present. Meanwhile, respondent marital status data are current. If the reported financial deceptions occurred during the respondents’ current marital status, then a relationship could be sought between those factors. However, because we cannot be sure when the reported financial deceptions occurred, these results should be interpreted as suggestive but not conclusive of whether a relationship exists between marital status and financial deception.

4Respondents who are currently “single, never married” were not given the option to answer that financial deception led to separation as a couple, ultimately resulted in divorce, or caused the couple to proactively communicate.

Among those who report ever combining finances with a spouse or partner and either committing a financial deception or their partner/spouse committing a financial deception:

- Women were significantly more likely than men to report that financial deceptions caused an argument (47 percent vs. 37 percent).

- Adults with children under 18 in their households were significantly more likely than those without to say the deception caused an argument (47 percent vs. 36 percent).

- One in five (19 percent) said the deception caused the couple to grow closer together, and 16 percent said the deception caused the couple to communicate proactively.

Read more on the latest financial infidelity poll and other NEFE polls.

Survey Methodology

This survey was conducted online within the U.S. by The Harris Poll on behalf of NEFE between June 28-30, 2021 among 2,073 adults ages 18+, of whom 1,248 reported ever combining finances with a spouse or partner. Of those who reported ever combining finances with a spouse or partner, 555 reported they had committed a financial deception, while 650 reported either that they or their spouse/partner had committed a financial deception. Results were weighted for age within gender, region, race/ethnicity, income and education where necessary to align them with their actual proportions in the population. Propensity score weighting was also used to adjust for respondents’ propensity to be online.