NEFE sponsored, supported and contributed to a variety of financial capability initiatives in 2014. Here are some of the highlights.

Study Challenges Financial Education to Evolve

We kicked off 2014 by reflecting upon the NEFE-funded research project The Effect of Financial Literacy and Financial Education on Downstream Financial Behavior, an unprecedented meta-analysis of existing financial education research led by John G. Lynch, Jr., Ph.D., of the University of Colorado–Boulder. Lynch and his colleagues examined the connection between financial education, financial literacy and the choices that people make about their finances.

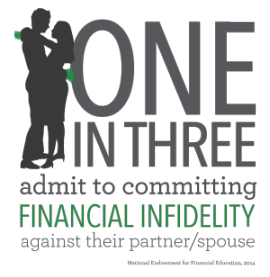

Survey Reveals Widespread Financial Infidelity

Survey Reveals Widespread Financial Infidelity

One in three Americans who have combined finances with a partner also have hidden or lied about some relevant money matter, ranging from concealing a purchase to lying about debt or personal income, according to a February 2014 NEFE survey of more than 2,000 adults. These findings continually capture interest, with mentions in Woman’s Day, Chicago Tribune, MSN Money, Consumer Reports, Men’s Health, Forbes, USA Today and more.

NEFE Counsels Washington Leaders

NEFE President and CEO Ted Beck joined the President’s Advisory Council on Financial Capability for Young Americans in February, which, under the direction of the U.S. Department of Treasury, will advise President Obama and his administration on ways to improve the financial skills of young Americans so that they can make smart decisions about going to college, using financial products and beginning to save for their retirement.

New Kits Empower Formal and Community Educators

Our Financial Workshop Kits continue to provide educators and other profession¬als with free, quality resources for teaching money management. Presentation materials, scripts, handouts and other resources give educators everything they need to make a difference in their communities. New kits in 2014 include Risk and Protection, Problem Gambling, First-Time Homebuyers, Protecting Against Common Types of Fraud and Money Management for Adult Learners.

NEFE-Funded Research Explores Financial Realities, Behaviors and Capabilities

NEFE-Funded Research Explores Financial Realities, Behaviors and Capabilities

NEFE-supported research in 2014 continued to advance our understanding of financial issues and what drives financial behaviors. The third wave of the long-term APLUS study from the University of Arizona continued to report on the employment and financial lives of young adults. Researchers at the Ohio State University examined the nature and impact of debt among Millennials. Columbia University completed an ambitious inquiry to better understand how financial behaviors relate to cognitive ability and financial literacy among normally aging adults. Look for more on these research findings in 2015.

HSFPP at 30: Serving all 50 States at 11.5 Million Students and Counting

In 1984, the organization that ultimately would form NEFE launched the High School Financial Planning Program. This year, as HSFPP turns 30, we celebrate its reach of 11.5 million students across all 50 states and at more than 100 military bases nationwide. The celebration will continue into 2015.

CashCourse Partners with California Community Colleges

In August, NEFE began working with the California Community Colleges Chancellor’s Office to build financial literacy campaigns for all of the state’s 112 community colleges. The project will span at least five years, incorporat¬ing the financial tools at CashCourse.org and giving NEFE another way to reach nontraditional student populations.

Lackluster PISA Scores Spark Teachable Moment

Building on the July announcement of results from the first Programme for International Student Assessment (PISA), NEFE helped energize a national conversation around financial literacy and capability. American students placed ninth in financial aptitude among PISA’s 18 participating countries—putting them in the middle of the pack and underscoring the need for better teacher training and continuous program evaluation and improvement.

Moneywise Events Spread Financial Capability Message

Moneywise Events Spread Financial Capability Message

NEFE continues its involvement with the MoneywiseEmpowerment Tour, a national outreach program of the Moneywise with Kelvin Boston public television series. The tour has served more than 35,000 minority consum¬ers and military members since 2006, providing needed financial information to African-American communities disproportionately impacted by the recession.