Harris Polls Shed Light on Financial Behaviors

Harris Polls Shed Light on Financial Behaviors

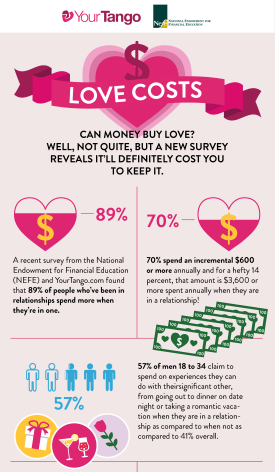

As in prior years, NEFE commissioned several Harris Polls in 2015 to gain insight into Americans’ thoughts and behaviors related to money. In a survey to kick off the New Year, we found that nearly 7 in 10 (64 percent) of adults in the top 10 U.S. markets planned to make a financially-focused goal in 2015 and that 1 in 3 (31 percent) rated the quality of their financial life as worse than they expect it to be.A February Harris Poll on “Love Costs” uncovered that 7 in 10 (69 percent) of Americans say they spend more money while in a relationship versus when they are single — although married people tend to spend less on gifts than those who are dating. And a summertime poll on technology usage found that 54 percent of Americans have used technology to set or achieve a goal, with 27 percent of those reporting that they’ve used technology to better manage their finances.

Money Teach Gives Running Start to New Financial Educators

Money Teach Gives Running Start to New Financial Educators

Disasters and Financial Planning

Disasters and Financial Planning

Website redesigns: HSFPP.org and Info.CashCourse.org

Website redesigns: HSFPP.org and Info.CashCourse.org style of the main site. In addition, the new site makes it easier to enroll in the program. CashCourse also unveiled a new blog where users can find news and updates from CashCourse and NEFE, as well as success stories from a few of the more than 900 CashCourse schools across the nation.

style of the main site. In addition, the new site makes it easier to enroll in the program. CashCourse also unveiled a new blog where users can find news and updates from CashCourse and NEFE, as well as success stories from a few of the more than 900 CashCourse schools across the nation.