1 in 5 U.S. Teens Lacks Basic Personal Finance Skills

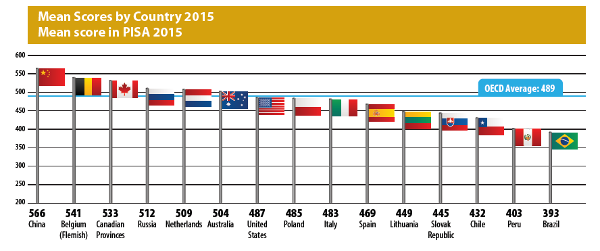

Results from the Program for International Student Assessment (PISA) show that one in five U.S. teenage students (22 percent) lacks basic financial literacy skills. China ranked number one overall, followed by Belgium and Canada. Chile, Brazil and Peru ranked as the bottom three. The Russian Federation and Italy showed measurable gains in average scores, while Poland, the Slovak Republic, Australia and Spain showed measurable declines.

Completely Average – Again: American Teens’ PISA Financial Literacy Scores

U.S. high school students tested on financial literacy have made no appreciable gains in the three years since the previous study by the Program for International Student Assessment (PISA) in 2012.The field heralded the first PISA study of 2012 as a benchmark for financial capability among the world’s 15-year-olds. The study, coordinated by the Organization for Economic Cooperation and Development (OECD), evaluates the financial literacy of teens from 15 countries. In 2012, the United States ranked near the world average, 9th out of 18 countries and economies.

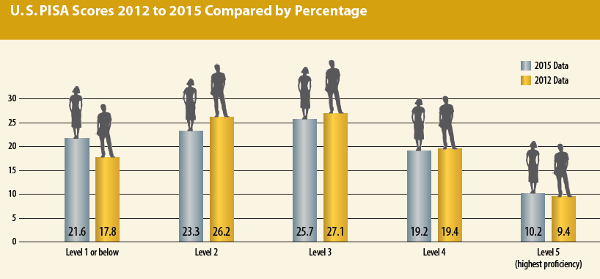

When the 2015 data was released this summer, financial educators hoped to see gains in American teens’ performance, but they were disappointed. The U.S. again mirrored the OECD average, 7th out of 15 countries and economies. And, although slightly more students scored at the top in this study (10.2 vs. 9.4 percent in 2012), quite a few more scored at the bottom (21.6 vs. 17.8 percent in 2012).

U.S. PISA Scores 2012 and 2015 Compared

The latest PISA release finds only about one in 10 students in the U.S. achieved the highest proficiency level as a top performer, defined by the report as students who can look ahead to solve financial problems or make the kinds of financial decisions that will be relevant to them in the future. The average score among U.S. teens was not different than the OECD average.

“These average results are concerning,” says NEFE CEO Ted Beck. “Looking only at the numbers, the United States has gone nowhere in three years. And the next PISA financial literacy study is coming up in 2018. Will we be able to show any progress then?

“Of course, the financial education situation in the U.S. is more nuanced than these scores reflect,” Beck continues. “Numerous programs in high schools and colleges are doing an excellent job of teaching our young people good financial management skills. More and better training is available to build teachers’ confidence and expertise. But there is no question that there is significant work yet to be done.”

The PISA study also reports just 3 percent of U.S. students from lower-income schools were high performers compared to 45 percent of students from higher-income schools. Among the lowest performers, 38 percent were from lower-income schools compared to 16 percent from higher-income schools.

One distinction is relatively easy to achieve. Among the U.S. students, 53 percent report that they have a bank account – and students with a bank account scored on average 42 points higher than students who do not have a bank account.

“Parents, get your child involved with a bank or credit union by having an account and learning to manage it during their teenage years,” says Beck. “We shouldn’t assume kids receive this education in schools. We need to step up and involve our children in regular, meaningful interactions with money.”

Programs meeting NEFE’s Five Factors for Effective Financial Education will have the most impact on learners, says Billy Hensley, Ph.D., senior director of education for NEFE. “Games and brochures definitely aren’t enough,” he says, “they can be used to supplement a robust curriculum but they can’t stand alone.”

Click to view larger image

About PISA

PISA is a triennial international survey which aims to evaluate education systems worldwide by testing the skills and knowledge of 15-year-old students in science, reading and mathematics. For the first time in 2012 it included an assessment of financial literacy, which was repeated in 2015. Approximately 53,000 students were assessed in financial literacy in 2015, representing about 12 million 15-year-olds in the schools of the 15 participating countries.

For more information about the study, visit http://www.oecd.org/pisa/aboutpisa.

NEFE’s Five Factors for Effective Financial Education

- A well-trained educator or e-learning protocol

- Vetted and evaluated program materials

- Timely instruction

- Relevant subject matter

- Ongoing evaluation and continuous improvement of program and materials