In 2008, a group of 2,098 freshman at the University of Arizona agreed to take part in a landmark research project. The Arizona Pathways to Life Success for University Students (APLUS) project has followed these Millennials over the past eight years to investigate how financial capability develops over time. Now approaching 30 years old, the study subjects have (mostly) achieved adult milestones such as completing education, starting careers and leaving home. But their journey reveals deeper questions about how gender, student loan debt and mindset impact financial well-being.

The Big Picture: Who are the APLUS Study Participants?

All participants in the APLUS study have at least one thing in common: They were freshman at the University of Arizona in 2008, and they now range from 26 to 29 years old, placing them squarely in the middle of the Millennial generation.

This is the fifth time the APLUS study has collected data on participants since 2008. About 900 participants (43 percent of the original sample) responded to an online survey in this round, (Wave 4), which took place in the spring/summer of 2016. The sociodemographic characteristics in Wave 4 match the original sample in Wave 1.

Researchers looked at sociodemographic characteristics to see how factors such as gender, race and family income affect financial capability.

Family Socioeconomic Status (SES): Socioeconomic status, commonly called SES, refers to the participant’s family background as reported at Wave 1 in 2008, not current status. Even if the participant now is in a different SES group, they remain part of their original SES group for the purpose of the study.

- Higher SES (Above $150,000) – 44 percent

- Middle SES (Between $50,000-150,000) – 24 percent

- Lower SES (Below $50,000) – 32 percent

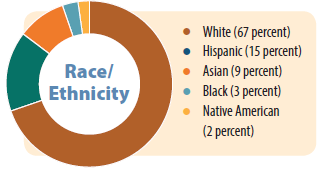

Race/Ethnicity:

Race/Ethnicity:

- White (67 percent)

- Hispanic (15 percent)

- Asian (9 percent)

- Black (3 percent)

- Native American (2 percent)

First-Generation College Students: When they started the study in 2008, 16 percent of participants reported they were the first in their family to attend college.

Click on the image to view larger.

See the full NEFE Digest PDF for more on the APLUS participants.

The Results: How Are Millennials Doing?

The good news: Researchers found few differences between sociodemographic groups in terms of their achievements, suggesting that — regardless of gender, race, family socioeconomic level, or first-generation college status — today’s educated young Americans can reach adult milestones.

However, there are differences in the extent to which certain groups thrive. For example, researchers found no difference in employment status for men and women, but women earn significantly less.

Gender

Men and women had relatively equal objective financial knowledge at the beginning of APLUS, but now in Wave 4, men scored higher than women in their real-world financial skills. Women are more likely to rely on family support. Men are more likely to investigate on their own before consulting family members for financial advice.

- 2/3 of study participants were women, 1/3 were men.

- 45 percent of men earn $60,000 or more annually vs. 27 percent of women.

- By Wave 4, men scored higher than women on objective knowledge (61.4 percent vs. 59.4 percent), despite being equal in Wave 1.

- Men’s assessment of their own knowledge rose in Wave 4, while women’s self-assessed knowledge dropped.

- “Financial self-efficacy” (one’s confidence in performing certain tasks such as paying bills) dropped for both men and women in Wave 4, but men still rated themselves higher than women rated themselves.

- Women were more likely to take a second job compared to men.

- Women were more likely to report receiving financial help from family.

- Women were more likely than men to borrow money to cover expenses (called reactive financial coping) in Wave 2; they were less likely than men to borrow in Wave 3; and they are relatively equal with men in Wave 4. Men’s reactive financial coping behaviors have remained fairly consistent.

- Men’s self-assessment of their own understanding of retirement accounts was 19 percent higher than women’s self-assessment.

- On average, men consulted a greater variety of sources than women, and men expressed greater reliance on the sources they consulted.

Student Loan Debt

To successfully pay off one’s loans, researchers found financial resources are important, but are not the only factor. While many participants said that navigating the complex loan repayment process was a major challenge, those who displayed better problem-solving behaviors were more likely to succeed.

To successfully pay off one’s loans, researchers found financial resources are important, but are not the only factor. While many participants said that navigating the complex loan repayment process was a major challenge, those who displayed better problem-solving behaviors were more likely to succeed.

- Repaying student loans was the highest financial priority reported by those who had them.

- Ethnic minorities, those from lower-SES families and first-generation students were more likely to be carrying student loan debt, and were more negatively affected by it (e.g., more stressed and more pessimistic about repayment).

- First-generation students reported greater pessimism about paying off loans than their peers.

- Women said the complexity of the loan repayment process and a lack of knowledge about options are barriers to paying off their loans.

- Women reported significantly more negative impacts from the loan repayment process, including that the experience was stressful, they were not managing it well, and that they were pessimistic about repayment.

- Participants from lower-SES backgrounds said financial strain was a key barrier to repayment.

- Participants who currently had student loan debt reported lower well-being than those who had paid off their loans or who had graduated without loans.

Mindset

Although the APLUS researchers did not find significant differences in achieving adult milestones according to sociodemographic characteristics, they did identify areas where certain groups are falling behind their peers, including general well-being and diminished financial capability.

- The data suggest that intangible factors — such as the ability to solve problems efficiently — are far more telling of a participant’s success than demographics. One group is struggling across the board: Women are far less confident about their financial knowledge than men; and unfortunately their objective financial knowledge compared to their male counterparts also is decreasing as they approach age 30. But why? Could it be that, once in the real world, social pressures, unequal pay, and traditional gender roles make it harder for women to keep up, even though they once were on equal ground with men?

- Participants from lower-SES families felt less control over their finances, less confident about their finances, and reported less healthy coping behaviors, despite being on par with their peers in the past.

- First-generation college students performed better than their peers in objective financial knowledge, yet they reported feeling less confident and capable.

- Unemployed participants reported the lowest levels of well-being.

- All participants who were currently receiving financial help from family reported lower well-being — even if they came from higher-SES backgrounds.

Takeaways

Financial capability alone doesn’t translate into success with adult financial responsibilities. Mindset and approach to solving problems makes a difference.

- Parents play a financial support role for many young adults, and still rank among top sources for financial information.

- The complexity of the student loan repayment process can be a barrier to repayment, even for those who have financial resources.

About the APLUS Study

The Arizona Pathways to Life Success for University Students (APLUS) project launched in the spring of 2008 with 2,098 University of Arizona freshmen. Researchers followed and surveyed the participants five times from 2008 to 2016. The principal investigators are Joyce Serido, Ph.D., University of Minnesota, and Soyeon Shim, Ph.D., University of Wisconsin-Madison. Report findings from each wave are available at http://aplushappiness.org, or read the executive summaries at www.nefe.org/research.