Today’s social workers face challenges unlike anything before: mental illness, substance abuse, poverty, financial insecurity — and a large population of aging Americans that is likely to need social work support for decades to come. Already advising on complex topics like housing, public benefits and health insurance, social workers may soon add financial education and guidance to their services. But would training social workers to increase the financial capability of their communities be too much to ask of an already strained profession? Or might it be an essential ingredient that has been underestimated all along?

Today’s social workers face challenges unlike anything before: mental illness, substance abuse, poverty, financial insecurity — and a large population of aging Americans that is likely to need social work support for decades to come. Already advising on complex topics like housing, public benefits and health insurance, social workers may soon add financial education and guidance to their services. But would training social workers to increase the financial capability of their communities be too much to ask of an already strained profession? Or might it be an essential ingredient that has been underestimated all along?

History of Social Work in the U.S.

There have been formal groups to help the poor, children and the mentally ill in the United States since before the American Revolution, but social work as we know it emerged just after the Civil War, when President Lincoln authorized Clara Barton to form an agency to locate and identify missing soldiers. By 1881, she and her partners founded the American Red Cross, often cited as America’s first formal social work organization. Public opinion about social work has shifted with the times, but the need has not slowed down. The social work profession is predicted to grow 16 percent within the next 10 years.

See the full NEFE Digest PDF for a timeline of social work in the U.S.

What Does the Future Hold?

Social workers must navigate issues ranging from survival needs like housing and medical care to chronic conditions like PTSD and substance abuse. What challenges face social workers in the near future?

- Widening wealth inequality – The wealthiest 1 percent of Americans controls 40 percent of the country’s wealth and the average American’s wages have not increased at the same rate as the cost of living.

- Aging society – By 2030, one-fifth of Americans will be 65 or older.

- Housing insecurity – In cities across the nation, families can’t find affordable housing, and millions are on waiting lists for housing vouchers.

- Student debt – 44 million Americans owe $1.4 trillion in student debt; African Americans with bachelor’s degrees carry more than twice the debt of whites.

Potential Positives

As the need for social workers increases, so does the need for educational infrastructure to train them. The number and quality of social work education programs continues to grow and adapt to new technology.

- Increased evidence-based practice – More social work programs and trainings are using data to plan, track and evaluate their initiatives. Better data helps to see what’s working and what’s not.

- Online education options – Web-based trainings, classes and info sessions mean social workers can stay current on the latest resources and changes to legislation affecting their communities.

For more on the future of social work, see the “12 Grand Challenges” Initiative at the American Academy of Social Work and Social Welfare (AASWSW) website.

3 Reasons Americans are Financially Vulnerable

-

They have low levels of resources.

Due to decades of persistent poverty and widening inequality of income and wealth, many American families have very few resources to build on. The cycle of poverty continues as generation after generation struggles to get ahead — and the divide is wider for nonwhite families. Note that income and wealth are not the same. Income typically is thought of as money earned through work, while wealth is a person’s net worth, or the value of what they would own after paying off all their debts.- Over 12 percent of Americans (41 million) and 18 percent of children live in poverty, with even higher poverty rates for racial and ethnic minorities.

- Real median income for white households is 65 percent higher than that for African-American households and 36 percent higher than that for Hispanic households.

- In 2016, the median wealth of upper-income families was seven times that of middle-income families and 75 times that of lower-income families.

- A recent study found that white households had 10 times more wealth than African-American households and eight times more than Hispanic households.

-

They lack appropriate financial services.

More than a quarter of American households either lack access to basic financial services or use expensive and sometimes risky financial products such as payday loans. Many of these individuals have low income, are young or old, and identify as members of racial or ethnic minority groups.- About 9 million households (7 percent of the population) are unbanked. They do not have a savings or checking account with a financial institution.

- Another 24.5 million households (20 percent of the population) are underbanked. They have an account, but also use alternative financial services like payday loans, auto title loans, pawnshops and check cashing services.

- An estimated 26 million adults are “credit invisible,” meaning they have no credit record. Another 19 million have an unscored credit record, limiting their access to favorable credit terms.

-

They have low financial literacy.

Despite the increasingly complex array of financial decisions faced by families, many Americans lack adequate knowledge and skills to manage their financial lives effectively, which can lead to short-term disruptions and long-term insecurity.- A study using a simple measure of financial literacy found that U.S. adults on average could correctly answer only three of five basic financial knowledge questions.

- One-quarter could not answer a basic question on interest rates, and 41 percent could not answer a simple question on inflation.

- Scores for financial well-being are lower among those who report lower levels of “financial know-how” and confidence.

Why Americans Need Financial Help (Now)

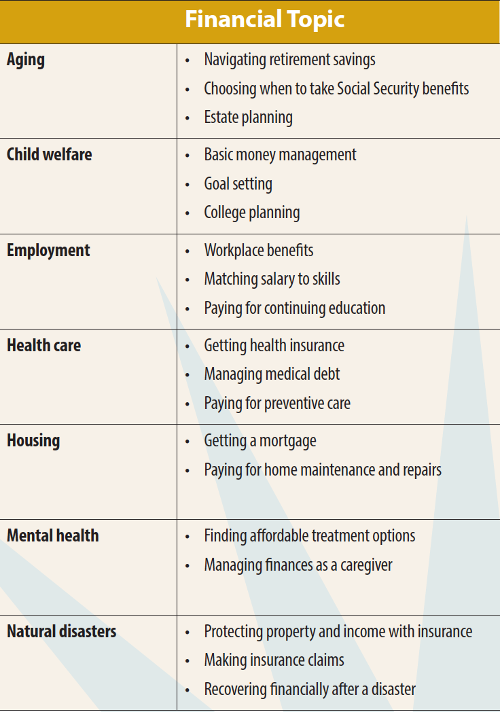

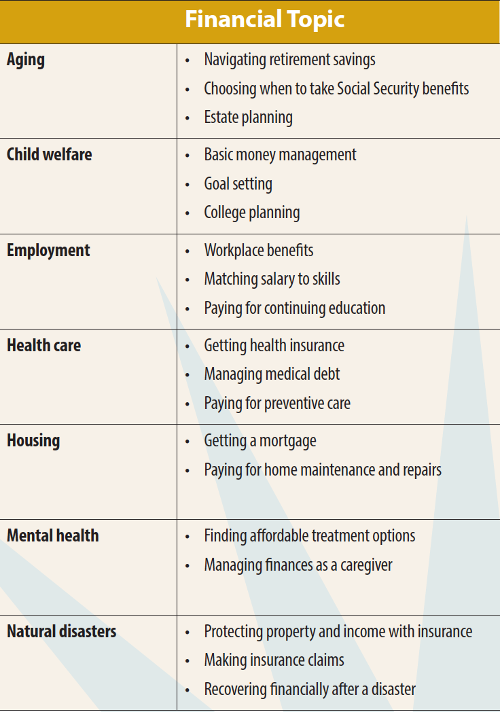

Social workers deal with a wide range of issues. One social worker might be helping find treatment for an opioid addiction, while the next is placing a child in foster care, and the next is doing crisis management after a hurricane. At first glance, these might not seem to have much in common, but there is a financial component underlying just about every situation a social worker might face.

Financial Education in Social Work Today

New NEFE-funded research from Washington University in St. Louis investigates how much financial education is currently being taught in programs to train social workers around the country — and which financial topics social workers believe would benefit them the most. With the social work occupation expected to grow 16 percent in the next 10 years and social work education broadening its reach through online learning, this could be a critical time to integrate financial topics into the standard social work curriculum.

4 Key Questions and Takeaways

Washington University researchers conducted an email survey of 1,577 faculty members who taught in accredited social work programs at colleges and universities from August 2016 to May 2017. Their study focused on four main questions:

-

What is the amount and type of financial content currently taught in social work courses?

The researchers categorized financial and economic content into three groups: financial products and services, public policies and programs, and financial management and practices. Within each group, the topics are ranked by the percentage of respondents who said that they have “never taught” this content. For example, more than 80 percent said they had “never taught” content about credit reports or identity theft. (See the full NEFE Digest PDF for the results.) -

How useful do social work faculty think financial topics are in preparing students for practice?

Among the faculty respondents who provided a valid response, nearly all (91 percent) agreed with the statement that “students would benefit from more financial or economic content than is currently being taught.” The recognized usefulness of these topics, in contrast to the lower percentage who are teaching these topics, suggests a call for more financial education in social work education. -

Among social work faculty, what are the perceived barriers to and opportunities for teaching financial content?

Among those who said more financial content would be beneficial, lack of time and faculty expertise were cited as primary barriers. Even some of those who do not think students would benefit from more financial content indicated lack of time as one of the main reasons. Time and flexibility to teach financial education are real limitations, but the research shows that people who have received financial education themselves are more likely to teach it. This suggests the importance of adding financial capability content to the social work curriculum and increasing faculty exposure to and training in financial capability. The more people in the social work profession who receive financial education, the more these perceived barriers might fall away. -

What are faculty’s recommendations for including financial content in the social work curriculum?

Faculty recommended infusing financial education in existing courses, adding elective courses or offering extracurricular activities. Most respondents recommended online mechanisms (webinars, online courses and other online resources) as the best ways to teach faculty. These preferences are not surprising given time pressures and possible discomfort about teaching financial matters. Online, faculty can learn at their own pace and convenience.

About the Study

The final report, Faculty Perspectives on Financial Capability and Asset Building in Social Work Education, was produced as part of the Financial Capability and Asset Building (FCAB) initiative at the Center for Social Development in the George Warren Brown School of Social Work at Washington University in St. Louis.

The researchers are Margaret S. Sherraden, Ph.D., Jin Huang, Ph.D., Lissa Johnson, MSW, Peter Dore, Julie Birkenmaier, Ph.D., Vernon Loke, Ph.D., and Sally Hageman, MSW.

More information on methodology, analysis and limitations are available in the full report.