Frankly, we at NEFE are not surprised by the Washington University findings about financial education and social workers. We’ve seen this before. In a 2009 study by the University of Wisconsin-Madison, less than 20 percent of K-12 teachers felt “very competent” to teach personal finance, but 89 percent agreed it was important for students to learn before graduating from high school.

Clearly, we needed a way to increase teachers’ competence to inevitably raise their confidence. The financial capability community stepped up to collaborate on a new teacher training initiative, the Jump$tart Financial Foundations for Educators (J$FFE) model, a replicable program, which focuses on a learner-centric approach to building teachers’ confidence and was tested in five states.

The Jump$tart Financial Foundations for Educators program (J$FFE) was designed to ensure consistency and rigor in national teacher training programs and is administered by the Jump$tart Coalition on behalf of its partners and affiliates.

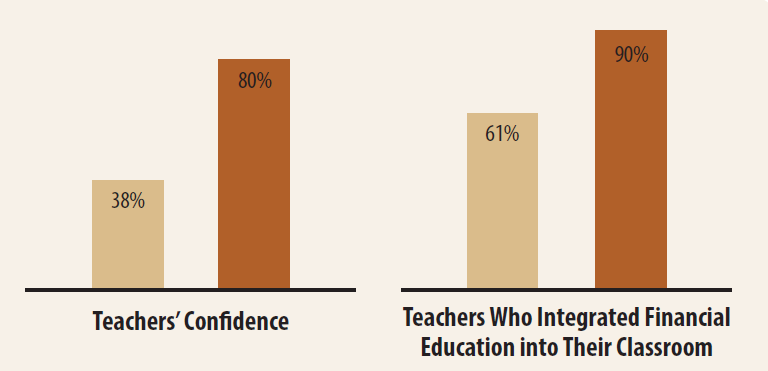

As a result of receiving the J$FFE training:

- Teachers’ confidence increased from 38 to 80 percent.

- Ninety percent of the teachers who received the training integrated financial education into their classroom instruction — up from 61 percent prior to the training.

A two-year pilot in Vermont also showed that students taught by well-trained teachers improved their financial literacy by an average of 17 percent. This is powerful evidence that better financial capability is achieved through well-trained teachers.

Almost all (91 percent) social work faculty in the Washington University study felt students would benefit from more finance and economic content than is currently taught; and the majority (61 percent) said a lack of faculty expertise was standing in the way, which may point to faculty lack of confidence.

If teachers’ confidence and likelihood to teach personal finance could increase so dramatically after receiving comprehensive training, it is likely that social workers would experience similar results.

Building on Teacher Training Success

We have what we need to truly make a difference in the financial capability of this nation. We know how to effectively train teachers and we know that students benefit more from well-trained teachers. These pilot studies also provide blueprints for evaluation of changes in knowledge and behavior for both teachers and students.

We believe that the tools used to train classroom teachers can be adapted to the needs of social work school faculty and students so they too can benefit from more confidence and better financial behaviors. Although research provides concrete data on why intermediaries don’t teach personal finance, we really don’t need any more research to assume that this imbalance (most don’t feel competent to teach it, but most feel it should be taught) carries through most of the helping and teaching professions. Let’s just proceed as if it is given.

The beauty of this teacher training model is that it helps both students and adults improve their financial behaviors. It is not solely focused on a sliver of the population. Research shows it works for every age group — teachers directly, and students indirectly.

It is time for us to take a stand on what constitutes financial education. There is a big difference between a one-hour game or simple flyer and a comprehensive personal finance curriculum. In order to be effective for its learners, financial education needs to include the 5 Key Factors. It’s confusing for students, teachers and consumers when materials that fall short are labeled “financial education,” and makes it easy for critics to proclaim that “financial education doesn’t work.”

We know that many of our readers already are in alignment on these principles and we applaud your dedication and high standards. Take a stand with us to inform influencers about the proven resources available to boost financial capability in their communities. Insist on using high-quality instructional materials and reach out to like-minded organizations to build coalitions to improve financial capability for all individuals and families. If we don’t make training teachers and intermediaries such as social workers a priority, we are failing the public we are committed to serve.