It is a commonly held belief in America that a college degree facilitates income potential, career advancement and financial stability. Student loans make college possible for many students, while simultaneously commencing their lives under the burden of debt.

Examining the debt journeys of young adults, beginning with education loans, new NEFE-funded research quantifies debt holding by level of education completed and identifies the corresponding financial precarity as young adults progress through their 20s.

What it finds is a much different—and sometimes more financially vulnerable—experience for those who obtain associate’s degrees. Community college attendees share unique characteristics as they seek higher education and accumulate unique debt portfolios compared with bachelor’s degree holders.

Often overlooked by those who assume a traditional four-year college experience, two-year degree holders deserve closer attention—and a different approach.

Educational Attainment and Debt Profiles

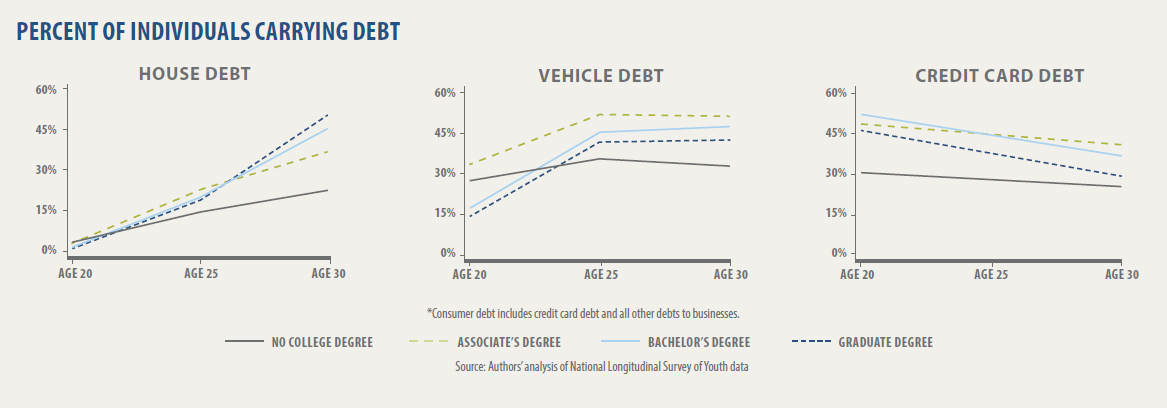

“The story of young adulthood is the story of debt holding,” says researcher Rachel Dwyer, Ph.D., of The Ohio State University, who conducted this study for NEFE. Dwyer investigated financial inequality and insecurity among Americans from age 20 to 30, focusing on individual and household educational attainment and the types of debt held. She examined student loan debt along with secured and unsecured consumer debt to illustrate the broader financial risk experienced by young adults with education ranging from high school diplomas to graduate degrees. “While debt does not always become an unbearable financial burden, it makes young adults more vulnerable to financial problems when troubles do arise,” Dwyer says.

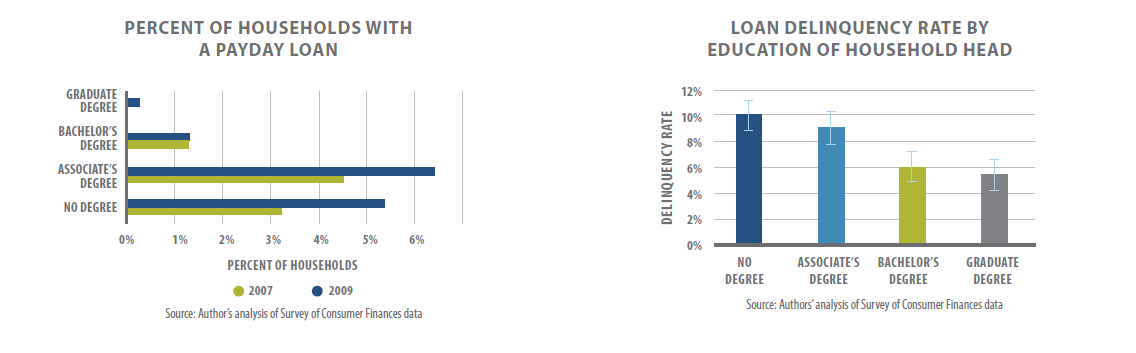

Community college attendees are at the forefront of this vulnerability, particularly compared to traditional four-year college attendees. They represent a financially precarious population attempting to get ahead by investing in postsecondary education. On average they are more likely to start school later and stay in school longer despite a shorter overall degree program—only 39 percent have earned a two-year degree within six years of starting. (In comparison, 60 percent of those who started at a four-year institution have earned a bachelor’s degree within six years.)1

Differences in Student Loans

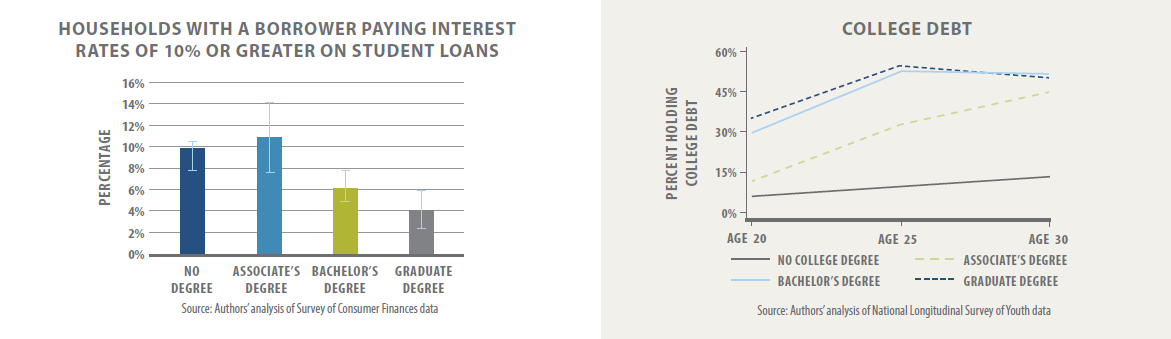

Like their four-year college counterparts, two-year college attendees take out student loans to cover education costs. In fact, similar proportions of individuals with bachelor’s degrees and associate’s degrees carry college debt. However, nearly 11 percent of associate’s degree-headed households are paying the highest loan interest rates (over 10 percent) compared to 6 percent of bachelor’s degree-headed households. This is likely a result of taking on private loans, which often carry higher interest rates than federal loans.

Bachelor’s degree holders are more likely to have student debt across the entire age range reviewed in this study, first increasing in proportion and then decreasing as they pay it off. The proportion of associate’s degree holders with student debt increases steadily over time.