Kindergartner Douglas knows that banks are where you get money, but also says banks are places that “bad guys rob.” Brian, another kindergartner, points out that people go to banks for money and “to get free stuff… [maybe] gum and suckers.”

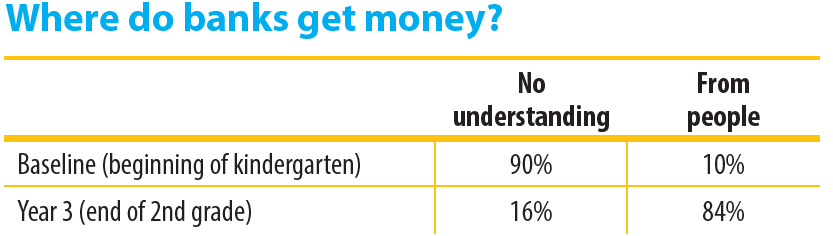

By second grade, these boys and fellow participants in a NEFE- funded study from the University of Kansas knew a lot more about banks, including that they were places to deposit and withdraw money and keep money safe. Researchers followed 40 kindergartners for three years to learn more about how children’s understanding of financial concepts develops. And although the qualitative study was small, it aligns with commonsense beliefs about the impact of financial education in schools, child savings accounts and parental influence.

Children in two treatment groups received 12 in-class financial education lessons in kindergarten, followed by multiple instructional packets sent to their parents throughout their first- and second-grade school years. The lessons covered spending, saving and banking. One treatment group also opened child savings accounts, while the other control group received no intervention. Researchers interviewed both parents and children prior to the study and at the end of each school year.

Children’s financial knowledge improved faster among those who received financial education than among those who did not. Researchers attributed this knowledge gain to both the direct effect of the lessons on the child and to changes in the parents’ financial socialization of the child through the letters sent home after each lesson. Those children whose parents used financial terms were better able to explain concepts than students whose parents did not use financial terms.

Many of the parents, including some in the control group, stated that being part of the study and responding to the interview questions made them more aware of the need for helping their children develop financial awareness and savings behaviors. Several parents said they had thought more about their own financial capability and started working to improve it.

Having savings accounts in the program prompted more of those children to interact with their accounts and use them (rather than a piggy bank or box at home) to save. The study sample was too small to discern other notable differences. Regardless of which treatment group the child belonged to, parents had a significant impact on their children’s understanding of saving, wants and needs, and goal setting.

Having savings accounts in the program prompted more of those children to interact with their accounts and use them (rather than a piggy bank or box at home) to save. The study sample was too small to discern other notable differences. Regardless of which treatment group the child belonged to, parents had a significant impact on their children’s understanding of saving, wants and needs, and goal setting.

“The parent-child interactions in this study support our understanding of just how critical parents are in the financial socialization of their children,” says Billy Hensley, Ph.D., NEFE president and CEO. “And we also see the critical importance of starting early to talk to our kids about money—both at home and at school.”

PROCEED WITH CAUTION!

These interviews show only what children can articulate. Five- and six-year-olds may not yet have the vocabulary to express their complete understandings, often making their responses difficult to interpret. The researchers also had to balance the depth of their questioning with the children’s short attention span. They tended to tire of the interview after 15 to 20 minutes. [The children, not the researchers…]