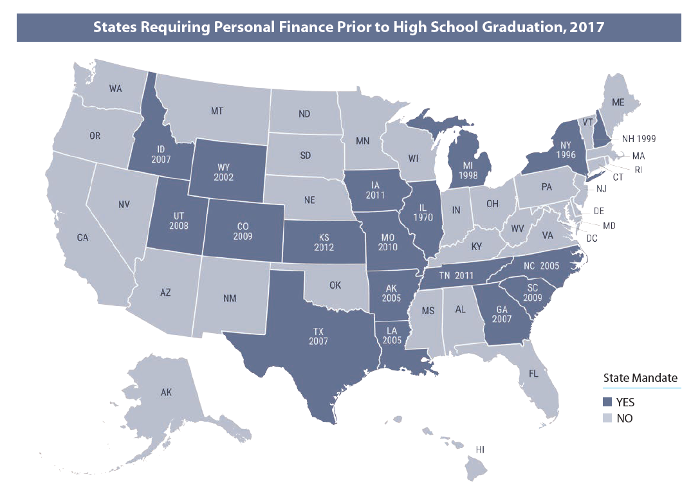

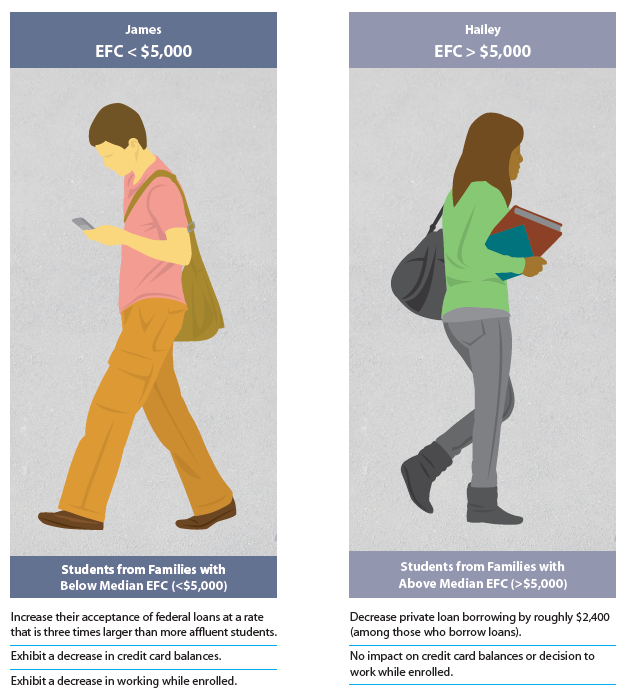

A new NEFE-funded study adds to the body of evidence that financial education mandates improve financial outcomes. Students in states where financial education is required to graduate from high school make better financial aid decisions as college freshmen, shifting from higher-cost to lower-cost borrowing options. Students with lower Expected Family Contributions (EFC) tend to carry smaller credit card balances and are less likely to work during their freshman year when exposed to education through a mandate. And higher-EFC students take on smaller amounts of private loan debt.

Making Better Borrowers

This study, conducted by Carly Urban, Ph.D., and Christiana Stoddard, Ph.D., at Montana State University (MSU), is the first to determine the causal effect of financial education graduation standards on positive college borrowing behaviors. It finds a distinct increase in applications for financial aid and in acceptance of both grants and federal loans when financial education coursework is required by the student’s home state in order to graduate from high school.

Mandates have positive effects on incoming college freshmen, although the effects are different for higher-EFC and lower-EFC students. Students from lower-EFC backgrounds take on more federal loans, have smaller credit card balances and are less likely to work, potentially allowing them more time to focus on their studies, and possibly shortening their total time in college and improving their likelihood of graduating.

For students who take on private loans, the existence of a mandate results in a notable reduction in the amount borrowed — $1,300 on average.

[Note: This research segmented students by EFC above and below $5,000 to distinguish the effects of mandates. It is understood, however, that EFC is an index number for institutions to allocate financial aid, even though many students and families believe it means the amount of money they should contribute to college costs.]

College Enrollment Decisions Unaffected

Mandates do not affect the biggest and most basic financial decisions about college. Students exposed to financial education are no more or less likely to:

- Go to college

- Choose a college with a different tuition level

- Choose a different type of education

- Choose a more selective college

- Choose a different financing option based on the initial college choice

This research suggests that high school may be too late to influence students’ decisions about whether or not to attend college or the type of higher education they pursue. However, it is not too late to nudge students toward more beneficial decisions about financial aid.

Elective vs. Mandated Financial Education

Simply offering a course is not enough to change college financing behavior. Without mandates, elective courses do not appear to have the same positive effects as state requirements for all students. The study tracked students in Montana, a state without a mandate, based on stand-alone personal finance course offerings in high schools. Ultimately, the analysis found no influence on average college financial aid packages and no effect on having federal loans or grants when financial education electives are offered. There was not enough information to determine whether this was due to low take-up, poor implementation, or the type of student voluntarily taking the class.

Finding the Sweet Spot

This study also contributes to previous research from NEFE and others on how to evaluate optimal student debt options and amounts.

“The term ‘student loan debt’ overshadows what should be a more analytical discussion of how to finance college,” says Amy Marty Conrad, managing director of CashCourse, NEFE’s postsecondary financial education program. “Of course, any reduction in the amount borrowed and any improvement in the borrowing terms will improve the bottom line for students and their families.”

Conrad says this is just one approach. “Taking on a realistic amount of debt is crucial, whatever that is for each person’s circumstance. But we’re learning that doesn’t always mean less. Some students benefit from taking out more loans — often that allows them to finish faster and begin repayment sooner.”

Benefits Beyond Freshman Borrowing Decisions

The effects described in this study are likely understated, as it examines only initial borrowing decisions of incoming college freshmen. It’s likely that there are cumulative effects of the high school requirements over the course of a student’s college career, including effects on persistence, graduation and post-education financial behaviors.

Additionally, high school financial education graduation requirements can significantly impact key behaviors beyond college. Previous literature finds that mandated financial education in high schools also reduces non-student debt, increases young adults’ credit scores and decreases severe delinquencies. This broad set of impacts suggests that mandated financial education contributes to a range of improved financial decision making among young adults beyond their formal education years.

Call to Action: Improve Foundational Research Data

Beyond its findings, this MSU research is notable for its commitment to building and testing data. For example, MSU used research assistants to contact every high school in Montana directly to determine the nature of the school’s financial education offerings.

MSU also independently researched state mandates rather than relying on existing information that sometimes was incorrect. And the researchers examined numerous potential influencers besides mandates (for example, state unemployment rates, SAT scores, and other high school graduation policy changes such as total math credits required) to confirm that students’ behaviors resulted from the mandates and not other external factors.

This leads NEFE to address the fact that research on financial education mandates is only as good as the information available on the mandates and course offerings themselves.

“Incomplete and out-of-date information compromises the integrity of the field’s research,” says Billy Hensley, Ph.D., NEFE president and CEO. “If we don’t know the exact nature of how mandates are implemented at the state, school district and school level, we can’t offer meaningful evidence on how financial education works.” While many organizations and researchers strive to compile this information, they are met with multiple barriers.

Mandates are relatively easy to track, but implementation varies widely and can change frequently. For example, are the mandates funded, and does that funding change year to year? Are specific resources required or recommended? Are these communicated to schools or easily accessed? How are teachers chosen and trained to provide instruction?

The definition of what constitutes financial education is not standardized and includes very different types and lengths of interventions. Clarification of the details of what is called financial education at the school level is necessary to conduct research accurately. However, collecting this data is time-consuming, expensive, requires regular updating and is not academically rewarded.

“Improving the precision of our research is critical to making the case for effective financial education,” Hensley says. “If we want to advance as a field, we need to be willing to embed extra time and funding into our research grants — and to share these data with other researchers. Accurately reflecting the outcomes of financial education depends on it.”