This past year represented another clear example of the increasing public demand for effective financial education for students. As four states passed legislation making personal finance a required course for high school graduation, access to financial education for youth has significantly expanded once again. Thirty states across the country have now taken this measure to ensure future generations receive foundational knowledge of personal finance, with 25 of these states doing so in just the past decade. Polling from the National Endowment for Financial Education (NEFE) reveals a key factor behind this momentum—near-universal public support. It was unwavering across demographics and party affiliations, as indicated by both our spring 2025 and fall 2025 polls.

As more states work to expand access, our polling helps to understand the driving forces behind this momentum and if there is a high level of support in states that have yet to pass graduation requirements into law. Through oversampling in our spring 2025 poll, we were able to gather additional information about the populations of three such states: New York, Washington and Maine.

Taken together, the findings from both polls reinforce the overwhelming public support for financial education, which is viewed as both valuable and necessary. Across states and demographics, people see financial education as an essential part of preparing students for adulthood. Those who have received it tend to view it positively, while many who have not received it expressed that they would have benefited from it. This widespread agreement highlights the increasing expectation that personal finance should be a standard, required course for high school students.

Landscape of Support for Financial Education

All demographics widely support the inclusion of personal finance education in high school curricula. In our spring 2025 poll (n = 800), 83% of respondents believed their state should require financial education to graduate, with no demographic falling below 75%. Additionally, 82% said they wish they had been required to receive this instruction in high school, with no demographic falling below 71%. In our fall 2025 poll (n = 1,200), respondents were asked to choose up to six out of 10 possible courses for their ideal core curriculum. The support for financial education was clear. “Economics/Personal Finance Education” was the top choice, selected by 76% of respondents, and no demographic fell below 72%. All ages, incomes, races, genders and educational levels demonstrate broad support for including financial education in core curricula for high school students. We then split up “Economics” and “Personal Finance Education” when asking respondents if common high school courses should be required, elective or not offered. We found that 80% of respondents believe “Personal Finance Education” should be required for all students, compared to 69% for “Economics.” When asked to choose up to three courses where they would like to see additional funding allocated (e.g., teacher training, professional development, materials, etc.), “Personal Finance Education” also topped this list with 46% of respondents advocating for additional funding for these courses.

Our fall 2025 survey also highlighted the effectiveness of financial education at the high school level. Respondents were asked if they had had the opportunity to take a course or training focused on personal finance and whether it happened in a school setting.

-

Those who had taken a course (n = 500) were asked how long the instruction was—a full semester or course, a few weeks or several lessons, a single workshop or class, or informal tips, videos or advice only.

-

This was followed by a question on how valuable they consider the personal finance course or training they received.

-

If they did not have the opportunity to take a course or training focused on personal finance (n = 675), they were asked if they believed the quality of their financial life would be better if they had received financial education in school.

In total, a quarter of respondents (25%) had taken a personal finance course or training in school, 17% had taken it outside of school (e.g., community program, nonprofit, religious group, employer or online course), 55% had not taken one and 2% were unsure. The data show that 86% of those who took either a full semester or course were more likely to find it somewhat (22%) or very (64%) valuable, compared to 76% of those who only took a few weeks or several lessons and 71% for a single workshop or class. NEFE considers a "full requirement" as one that ensures students receive a semester of personal finance, whether that be a standalone semester course or an embedded semester within a year-long course, and these results reinforce the importance of this approach.

In contrast, 70% of adults who reported not having an opportunity to take a personal finance course believe the quality of their financial life would be better had they received financial education in school, while 11% believe it would not be better and 19% are unsure. Younger adults (ages 18-49 years old), Black adults, Hispanic adults, parents of K-12 students and those with household incomes under $50k are more likely than their demographic counterparts to believe the quality of their financial life would be better had they received financial education in school. In our 2024 poll focused on financial well-being, we found that these same demographics were consistently reporting their quality of financial life as “worse than expected” compared to their demographic counterparts. While we recognize that financial education is just one aspect of an individual’s lifelong journey toward financial well-being—mapped by our Personal Finance Ecosystem—individuals recognize that financial education can be a tool to increase the quality of their financial life.

The strong public endorsement of personal finance education in high school curricula expands beyond demographics—it is also consistent across political affiliations. In our spring 2025 poll, Republicans (84%), Democrats (83%) and Independents (85%) all widely believe that their state should require a semester or year-long course focused on personal finance education for high school graduation. In our fall 2025 poll, “Economics/Personal Finance Education” was selected as an essential course for core curricula by 75% of respondents who identify as Democrat or lean Democrat, 77% of those who identified as Independent, and 75% of those who identified themselves as Republican or lean Republican. Similarly, there is broad support across political affiliations for having “Personal Finance Education” be a required course rather than being offered as an elective or not offered at all. Broad, bipartisan support like this has enabled four states to pass full requirements this year alone—Colorado, Kentucky, Delaware and Texas. The vote counts behind these bills, and many others passed in recent years, all show clear bipartisan support, with many passing unanimously regardless of the political makeup of the state legislature. Our 2025 Legislative Review provides an in-depth analysis of each of these four states’ bills.

As more states incorporate personal finance into their core curricula, younger generations are receiving financial education at a higher rate. Two in five (40%) of respondents ages 18-29 say that they had taken a personal finance course, compared to just 23% of respondents ages 30-49. An estimated 73% of all high school graduates will have taken a personal finance course by 2031, when the latest states to pass graduation requirements finalize their implementation. Although this is a tremendous success in expanding access to financial education, over a quarter of all students across the country will live in a state without a personal finance graduation requirement. In 2024 and 2025, multiple states introduced bills to add a graduation requirement but were unable pass them for various reasons detailed in our legislative reviews. To better understand sentiments and perspectives from states that have yet to pass a full requirement, our spring 2025 poll oversampled adults in New York (n = 50), Washington (n = 50) and Maine (n = 50). This approach provides a clearer view of attitudes toward financial education in states still debating its inclusion in high school curricula. Looking at responses from New York, Washington and Maine, a picture of varying priorities emerges, but strong support for financial education remains consistent.

Focus States

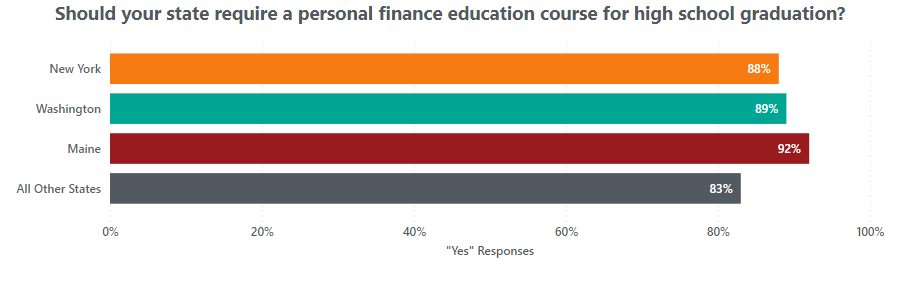

New York, Washington and Maine are three states in different regions, with different economies and demographics, yet they share a strong support for financial education. When examining the other 47 states, 83% of respondents believe their state should require a semester- or year-long course focused on personal finance education for high school graduation, while 90% of respondents from the aggregate of the three focus states share this view.

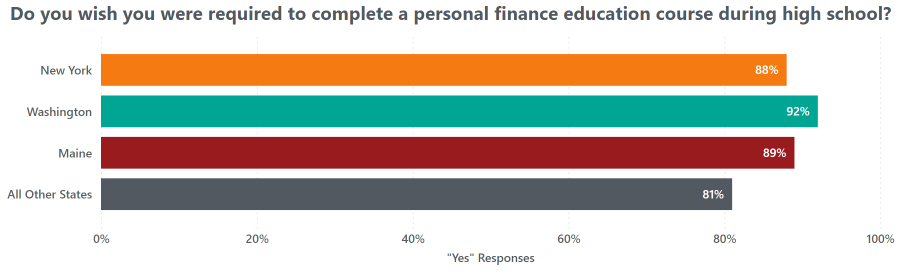

While these states have not been able to pass a requirement for financial education at the high school level, their constituents strongly support a state-level requirement. Similarly, 90% of respondents from New York, Washington and Maine wish they were required to complete a full personal finance education course during high school, compared to 81% of respondents from all other states.

These three states demonstrate overwhelming support for personal finance education, surpassing that of the rest of the United States. When asked if a personal finance education course was offered by the high school they attended, 30% of respondents in New York, 30% of respondents in Washington and just 13% of respondents in Maine said their high school offered a personal finance education course. Having a statewide requirement for financial education would increase these numbers to nearly 100% for future generations. For those who were provided the opportunity to take a personal finance education course, 77% of respondents in New York, 87% of respondents in Washington, and 77% of respondents in Maine completed these courses. The result is clear: There is a massive desire for financial education courses at the high school level, and when it is offered, most people take advantage of it.

New York

The state with the largest high school population yet to implement a full financial education graduation requirement is New York. The New York Board of Regents created the “Blue Ribbon Commission on Graduation Requirements” in 2019, which returned strong recommendations to adopt financial literacy as a high school diploma credit requirement. Although the state is now taking measures to expand financial education offerings for high school students, they still fall short of a full semester-long requirement. For instance, New York City is currently rolling out a “financial literacy for youth” initiative, adding financial educators to staff in 15 schools in the city to offer free workshops and counseling to students and their families. Separately, the Future Ready NYC initiative is facilitating financial education for a small group of students in New York City. Although New York City has taken measures to expand access to financial education in the K-12 system, and the Blue Ribbon Commission encouraged the state to do so as well, a full requirement still has not been implemented.

In our polling, respondents from New York are even more in favor of a financial education graduation requirement than the state’s Blue Ribbon Commission. While 85% of the commissioners recommended financial education as part of diploma requirements, polling shows 88% of New Yorkers favor the measure, also higher than 83% of all other respondents. When asked to prioritize three broad topics for financial education coursework, New Yorkers prioritized spending and budgeting (58% of respondents), saving (51%) and investing (44%). Every state, county and school district is different, and understanding the needs of constituents is crucial when crafting or curating curricula.

Washington

One of the other largest states remaining without a full graduation requirement is Washington. Over the past two years, the Washington legislature has introduced legislation to add a requirement for personal finance, but these bills have been unsuccessful to date. Similar to New York’s approach, Washington has established a task force to assess all state graduation requirements, and assessing the state of financial education is part of this mandate. Washington is unique in the way the state has already established a successful public-private partnership, known as the Washington Financial Education Public-Private Partnership (FEPPP), to support financial education programming across the state. This committee was originally created in 2004 (then the Financial Literacy Public-Private Partnership), and although Washington does not have a full graduation requirement, the work of FEPPP has supported and expanded the pocketed offerings of financial education throughout the state. As with New York and other states, this presents a situation where access to financial education has discrepancies across different student populations, depending on the priorities and resources of varying school districts.

This work is evident in our polling. Washington had the highest rate of respondents saying that they had taken a personal finance course offered by their high school (26%) compared to the other focus states and the aggregate of the remaining 47 states. While this highlights the need to continue expanding access in high school, it also underscores the work of Washington’s state and local officials who have been paving this groundwork for nearly two decades. The sentiment of Washingtonians supports the need to continue this work; 89% of Washington respondents said their state should require personal finance for graduation, compared to 83% of all states.

When asked about which financial topics were most important to learn, respondents from Washington heavily prioritized spending and budgeting (72% of respondents), saving (58%) and managing credit (54%). Future generations in Washington will benefit from this foundational knowledge as they receive financial education on these topics.

Maine

Maine has also been evaluating the idea of a financial education graduation requirement. Reflecting a trend among states without a requirement, like Washington and New York, the state is reviewing all graduation requirements before taking the action to add additional ones. Only 13% of Maine respondents said that they were offered financial education in high school compared to 29% of all others. The demographics of Maine may have an impact on these results (Maine has one of the oldest populations in the U.S., and as previously mentioned, younger generations are more likely to have had financial education offered in school), although these same respondents desire the financial education they themselves were not offered.

Just like Washington and New York, Maine’s respondents desire financial education in high school. More than nine in ten (92%) respondents from Maine said their state should require financial education for graduation—higher than 83% of all other states and the highest response among the three oversampled states. Looking at how respondents from Maine prioritize different financial education topics, we see that spending and budgeting (70% of respondents), managing credit (58%) and saving (44%) rise to the top. With advocates and legislators in each of these three states hoping to pass full financial education requirements in the future, understanding what topics constituents would find the most useful can be helpful in the crafting of curricula.

Conclusion

Through these two polls, what we have found is remarkable. There is overwhelming support for financial education, regardless of how the question is presented. It is supported as a full requirement on its own, and when placed among the many standard courses required in comprehensive curricula, it consistently ranks at the top. Those who have taken financial education are likely to find it useful, and those who have taken a full semester or course are even more likely to say so. Those who have not had the opportunity to take financial education wish they had, and these respondents also largely believe the quality of their financial life would be better if they had. The implications are clear. People want financial education, find it helpful if they’ve had it and those who haven't had it think they would be better off if they had. Individuals from our focus states (currently without full requirements) show even greater support for this legislation, and legislators, practitioners, and advocates who support financial education requirements should find these results promising.

As the polling results suggest, each state in the nation has a distinct cultural and economic makeup that influences which financial topics are most important to its citizens. While most states adopt financial education standards based on national standards, which capture the core principles necessary for financial education, no two states implement a requirement in the same way, and even various districts within the same state have their own differences. When teachers are sufficiently prepared and trained on the content, paired with efforts from the field to build curricula that speak to all students, the goal of offering effective financial education becomes clearer. Graduation requirements move states closer to a position of expanded access that ensures all future students are better prepared to navigate the financial system and improve their financial well-being.