In 2025, there was continued momentum in financial education with four state legislatures having passed bipartisan financial literacy high school graduation requirements to date, bringing the number of states to 29. This year’s annual review will look at the legislation that has passed, is still in progress and progress of implementation of these requirements. Kentucky, Colorado and Texas most recently signed their requirements into law. Delaware has passed the legislation unanimously, but as of publication is still awaiting Governor Matt Meyer’s signature.

The signing of the legislation in Texas ensures that an additional 1.7 million high school students will receive financial literacy education. With the addition of Kentucky, Colorado and Texas, once fully implemented by 2031.

73% of high school students in the country will receive a financial literacy education before they graduate. This is remarkable considering only 9% of high school students received a financial literacy education in 2017.

Champlain College’s Center for Financial Literacy released its National Report Card on State Efforts to Improve Financial Literacy in High School 2025 Interim Update, which provides updates on California, Colorado, Kentucky, Pennsylvania, Texas and Wisconsin. This update includes an article from the National Endowment for Financial Education (NEFE) on the challenges and successes around implementing financial education requirements.

During the 2025 legislative session, 25 graduation requirement bills were introduced in 13 states. Four full graduation requirement bills passed through their state’s legislatures and three have been signed by their governors as of publication. Additionally, two bills passed through the legislatures in North Dakota and Maine, but did not include a full graduation requirement. Nineteen bills remain pending in seven states: Alaska, Hawaii, Illinois, Massachusetts, New Jersey, New York and Washington.

As of publication, twenty-nine states now have a financial literacy graduation requirement. While this represents tremendous progress in expanding access to financial education for K-12 students, there is still much work needed to implement these requirements and ensure that every student gets a quality financial education.

Persistent advocacy, leadership, listening to stakeholders and passion for the issue were all factors in passing strong, bipartisan graduation requirement legislation. This review analyzes some factors that contributed to passing the full requirements, led to changes to the legislation or requests for information on financial literacy offerings.

Passing a requirement is just the beginning. With so many states currently in the implementation phase, now is the time to examine how states can implement the requirements in a way that provides quality instruction, curriculum and well-trained teachers for every student. NEFE recently released four papers covering best practices and case studies of how states have implemented the requirements, along with recommendations for states in the early stages.

Passed Requirements

The four states that passed legislation this year share similarities, including passionate advocacy from students, stakeholders and legislators. Colorado and Kentucky both had dedicated student advocacy. All the states had sponsors who were thoughtful about creating—and passing—meaningful legislation supporting students and teachers. Stakeholders used their expertise and resources to help craft and support legislation.

Kentucky

Kentucky passed HB 342 unanimously in the House of Representatives and Senate, and Governor Andy Beshear signed the bill on March 24, 2025. Patrick Graboviy, a high school student who understands the importance of financial literacy advocated for all students in Kentucky, and spearheaded the bill’s passage. Determined student advocates can keep pressure on policymakers to ensure the legislation’s passage.

HB 342 requires:

- Every student who enters ninth grade on or after July 1, 2025, must complete a one-credit course in financial literacy.

- The course will be counted towards an elective course requirement.

- The Kentucky Board of Education (KBE) will create administrative regulations to establish academic standards.

- Superintendents of school districts will consult with local school boards, principals and other decision-making councils to determine the curriculum for the course that aligns with the standards created by the KBE.

- Local schools and districts can consult with the Kentucky Financial Empowerment Commission (KFEC) when developing and implementing the standards.

Kentucky is creating a system that supports school districts by providing standards and guidance for implementation. Additionally, they encourage districts to utilize organizations such as the KFEC, which can provide implementation support and needed resources.

Read NEFE’s blog to learn more about Graboviy’s advocacy work, How Student Advocacy Changed the Future of Financial Education in Kentucky.

Colorado

Colorado’s legislature passed HB 25-1192 and Governor Jared Polis signed it on May 23, 2025. The bill passed the House 60-4 and the Senate 26-9, and further demonstrated its bipartisanship by having both a Democrat and a Republican sponsor in both chambers. Colorado continues the trend of unwavering bipartisan financial literacy legislation. Unlike some of the other bills this year, the Colorado legislation included a section to address low Free Application for Federal Student Aid (FAFSA) completion. Colorado ranks 45th in FAFSA completion, and the bill aimed to encourage more students to fill out financial aid applications and not leave funding on the table. The original bill required students to complete the FAFSA or the Colorado Application for State Financial Aid (CASFA). However, the enacted version requires students to have exposure and ability to practice filling out aid applications, unless they or their parents opt-out and requires schools to support parents and students in filling out the forms.

HB 25-1192 requires:

- A course in financial literacy is required for students to graduate.

- Students can take the course at any point during high school.

- Districts will determine what course financial literacy will replace and what department it will be under.

- The Colorado Department of Education (CDE) has already developed standards for financial literacy, which the financial literacy course will be required to cover. The standards will be reviewed and readopted in 2028.

- Beginning in the 2027-2028 academic year, students must be exposed to federal financial aid eligibility tools and price calculators, and practice filling out a FAFSA or CASFA form in their senior year.

Unlike many other requirements, this legislation included funding for the 2025-2026 school year. An appropriation of $210,389 from the general fund will be directed to the CDE, who will determine the amount of funding to be awarded to school districts that do not currently offer a financial literacy course. Adding requirements without teacher input is often a concern, but Colorado is showing support for teachers and districts by including this needed funding.

A broad coalition worked throughout the process to craft legislation that ensured a requirement that will support teachers, schools and districts through the implementation process. Organizations from the financial literacy space, banking and credit unions and school districts all worked together to craft this legislation.

Denver Public Schools (DPS) already passed a financial literacy graduation requirement in 2022, which goes into effect for the 2027 graduating class. Under DPS guidelines, the course can count under social studies or math, but most schools have placed it under social studies because that is the department the state standards are under. Districts are also encouraged to offer the course in 11th grade or 12th grade. DPS is a case study and resource for districts starting the implementation process. Every state has at least one school or district that has already implemented a financial literacy graduation requirement that can be learned from.

The DPS requirement was spearheaded and advocated for by DPS alumni who formed the non-profit organization EDNIUM. Along with its other priorities, EDNIUM leadership understands the value of financial education and wants to ensure that future students don’t graduate without this knowledge. Similarly, the state bill for a financial education requirement was strongly supported and advocated for by students from across the state, including students from DPS, Aurora Public Schools and Glenwood High School. Several teachers joined their students in advocating for the requirement. From Colorado to Kentucky, students are leading the effort to advocate for and pass financial literacy graduation requirement legislation.

Texas

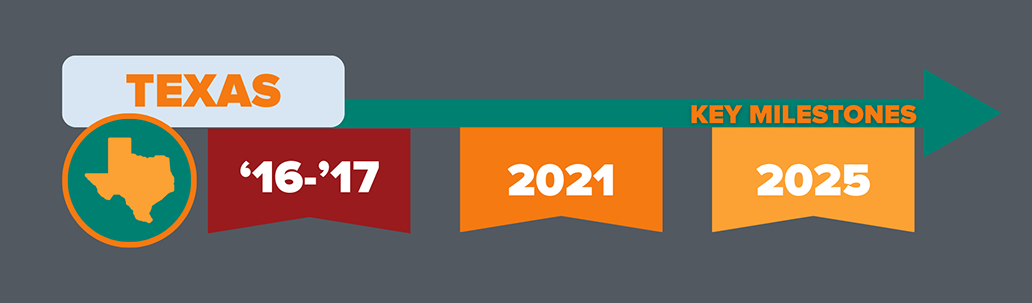

Texas has had a partial financial literacy requirement since the 2016-2017 academic year, when districts were required to offer a financial literacy course as a social studies elective. This partial requirement required students to take a half-credit of economics or a half-credit of personal finance and economics. Texas passed HB 27 this legislative session and Governor Greg Abbott signed the legislation on June 20, 2025. The bill passed the House 135-2 and the Senate unanimously.

HB 27 requires:

- Every student entering the ninth grade in or after 2026-2027 to complete a half-credit in personal financial literacy.

- The requirement will be a part of the social studies graduation requirements.

- An advanced placement course designated by the State Board of Education (SBOE) containing the same standards can also count toward the graduation requirement.

- The state Department of Education is responsible for developing a list of free, open-source curricula that districts can use.

The legislative sponsors understood that the partial requirement was insufficient for students and aimed to pass legislation so every student would receive a full semester of financial literacy before graduating from high school. Financial literacy in high schools grows over time, typically from the introduction of some information in math or social studies to ideally a full graduation requirement. How states move through that process differs greatly.

Delaware

Delaware passed HB 203-1 financial literacy graduation requirement unanimously in both chambers. It was sent to Governor Matt Meyer on June 10, 2025, but as of the publication of this review, the governor has not signed the legislation.

If signed, HB 203-1 will require:

- Students starting ninth grade in the 2026-2027 school year to complete a half-credit course in financial literacy to graduate.

- A half-credit course must align with the current financial literacy standards and include assessments.

- Districts must provide opportunities for high-quality initial and ongoing professional learning for teachers.

- The state Department of Education and the Professional Standards Board will determine the certification necessary for teachers to teach the course.

Delaware’s bill was amended in the Senate due to concern over which department the requirement would be included in. Lawmakers were concerned about making it count only as a social studies requirement because they did not want other social studies courses, such as civics, removed as requirements. Ultimately, the bill allowed for the course to count as a requirement under elective credits or social studies credits. The decision of how to count the course toward graduation requirement credits is determined by the districts.

Committed champions of financial literacy can make all the difference. Representative Jeff Hilovsky, a Republican in the minority and the prime sponsor of the legislation, introduced similar legislation in 2024. The legislation didn’t pass and was substituted for the bill requiring a study of financial literacy offerings. Representative Hilovsky has a passion for financial literacy and didn’t let the failure of the bill stop him from working tirelessly with stakeholders, legislators in the majority and the community to craft a bill that could be unanimously supported in 2025.

Not a Full Requirement

Legislation does not always follow a straight path, and negotiations can dramatically alter the final version. Just because members of the legislature make changes to a bill, removing a graduation requirement or requesting a review of offerings, does not mean a graduation requirement will never happen. Legislation can take time to be perfected and these steps are often just leading towards a full requirement.

Maine

This legislative session, Maine introduced LD 1069, which in the original version required a course in financial literacy for graduation. The bill was amended, and the substituted version, if signed, will not include a graduation requirement. Instead, it will direct the state Department of Education to review personal finance course offerings in Maine schools and convene a working group of relevant stakeholders. One-time funding of $15,000 was appropriated to support the working group in developing recommendations on increasing accessibility to personal finance education for all students at all grade levels. The bill was passed by both chambers and as of publication is awaiting signature by the governor. Concerns over implementation costs and the impact on teachers were some of the reasons the bill was amended to remove the graduation requirement. While there was advocacy and interest for the topic, sometimes that alone is not enough to get a bill over the finish line.

North Dakota

North Dakota passed HB 1533, which requires each student to complete a one-half unit of financial literacy or for schools to ensure that the curriculum for either the economics course or the problems of democracy course exposes students to personal finance concepts. The current requirement is to include personal finance concepts in the economics or the problems of democracy courses. This legislation allows schools to continue the status quo for teaching financial literacy and does not require that every student receives a semester or more of financial literacy to graduate. Due to this fact, NEFE does not consider this a full graduation requirement.

There is hope that schools see the value of providing students with a full one-credit course in financial literacy and decide to offer the full stand-alone course. However, without a state requirement, many districts will likely decide to maintain the status quo and not ensure that every student has the quality financial education they need to succeed in the future.

Studies to Understand the Issue

Several states have delayed passing a financial literacy graduation requirement bill because there has been pushback from education leaders that the topic is already being fully taught to the state standards. In 2024, Delaware HB 203 was introduced with a graduation requirement, but the bill did not move forward and HR 31 was passed requiring the state Department of Education to contract with the University of Delaware to conduct a curriculum alignment study by local education agencies. The report, released in May 2025, showed that only five of 31 local education agencies were aligned with criterion 1, which required instructional plans:

- 1a. included resources that meet the expectations of each grade-level financial literacy benchmark, and 1b. present a clear pathway for students to develop the knowledge and skills required by those benchmarks.

Maine also delayed a requirement in this legislative session and passed legislation to review personal finance course offerings. Maine is not conducting a rigorous study but instead surveying administrators on current financial literacy offerings.

These studies typically show that there is a need for a graduation requirement due to inconsistent teaching of financial literacy standards district-by-district and sometimes even school-by-school.

Research has shown that when the course is not required for graduation, females and students of color do not opt in for the course. When a state has no requirement, only 9.6% of Hispanic students are in a school with a required course (compared to 14% of white students). States with no requirements only provide 11.5% of all students with access to a required course. Without a requirement states are not ensuring that students have access to or are taking a financial literacy course.

Still in Progress

Washington

HB 1285 was introduced on January 14, 2025, and was substituted in the House and subsequently passed 94-3 on March 5, 2025. The bill was sent to the Senate, which referred it back to the House Rules Committee by resolution. Washington has a two-year cycle, and this legislation will continue through the process when the legislature reconvenes in 2026.

If passed as currently written, the bill will require:

- The graduating class of 2031 to meet the high school state financial education learning standards to graduate.

- The Washington Superintendent of Public Instruction will make a list of instructional materials that align with the financial education standards available to all school districts.

- Washington’s State Board of Education (SBOE) will review and monitor financial education offerings to ensure school district compliance.

- The Financial Education Public-Private Partnership (FEPPP) will create a statewide implementation plan and include recommendations for additional grant funding to integrate financial literacy education into professional development.

Washington has similar legislation to Kentucky, advocating for support from partner organizations to implement the bill and support schools and teachers.

This bill is similar to legislation introduced last session, HB 1915. HB 1915 passed the House unanimously but was amended in the Senate to remove the graduation requirement and the bill failed. For an in-depth review of the 2024 legislation, read Passing Legislation Is Just the Beginning: A 2024 Legislative Review of K-12 Financial Education Requirements.

In addition to the current legislation, the Washington SBOE created the FutureReady Task Force in 2024. This task force aims to update graduation requirements to better prepare students for the future. Financial literacy is an aspect of the task force’s work and could be an alternative method of adding a graduation requirement. New York had a similar strategy, using a blue-ribbon commission to evaluate graduation requirements. Unfortunately, the commission didn’t recommend adding financial literacy to the state’s graduation requirements. For more information on the New York blue-ribbon commission, read the 2024 legislative review.

Massachusetts

If H 594 is passed as currently written, it will require:

- Every high school student to take at least one stand-alone personal financial literacy course, which has to be at least one semester long.

- The Department of Elementary and Secondary Education shall provide professional development opportunities for educators.

Massachusetts has been introducing legislation to expand financial literacy or require a course for graduation for the past several sessions. If this legislation passes, NEFE will provide updated information.

How to implement the requirement

To support the ongoing implementation efforts of states, NEFE has developed resources that can be used by state officials, advocates or other stakeholders. These resources include best practices, case studies and recommendations. All four implementation papers can be found here.

States have debated, including recently Delaware, what the best home department for this requirement should be, with most states choosing the social studies department or making it an elective. Placing it under the electives umbrella does not give it a true home department. As discussed in NEFE’s implementation paper, Curriculum and Resources, giving the requirement a single place to live can ensure that the standards are fully taught and can increase the likelihood of additional funding. It is not clear which department is the best fit for a personal finance course, but choosing a home department early can prevent implementation issues.

Teacher training is a critical element of implementation. Most legislation does not provide funding or specify the type of professional development needed to teach financial literacy courses. Champlain College’s Center for Financial Literacy estimates that 28,361 trained personal finance teachers will be needed by 2031, and that number is expected to grow as more states pass requirements. NEFE’s Teacher Training and Professional Development implementation paper offers best practices around teacher training, funding and timelines.

Delaware’s legislation includes a requirement for assessments as part of the standards-aligned curriculum. Collecting feedback and evaluations of the requirement as it is being implemented can allow for course corrections before issues arise. It also allows for a long-term view of the requirements. NEFE’s Feedback and Evaluation implementation paper provides more details on best practices.

Kentucky and Delaware’s legislation included utilizing outside organizations to support the districts, schools, teachers and students through the implementation process and into the requirement. Organizations like the FEPPP and the KFEC can provide curriculum, professional development and other needed resources throughout the entire process. NEFE’s Partnership and Collaboration implementation paper has additional information on how to support a requirement.

It Takes Time

Even with all the momentum around financial literacy, legislation can still take time to get from concept to signature. Looking at the states that passed legislation this year, all of these states have been working to improve financial literacy for at least a decade. Most states start by including financial literacy standards in K-12 curriculum standards and slowly expand to creating a stand-alone financial literacy course. That does not mean financial literacy is not advancing in states without stand-alone requirements. There is usually a starting point to continue advocating for financial literacy already in place.

Washington Timeline:

- In 2004, HB 2455 creates the Financial Education Public-Private Partnership and every school district is encouraged to provide students with the opportunity to master financial literacy skills.

- In 2015, SB 5202 adopts financial education learning standards.

- In 2022, SB 5720 provides grant funding for school districts to support financial literacy and professional development.

Colorado Timeline:

- In 2004, a financial literacy resource bank was created, and school districts were encouraged to require students to take a financial literacy course.

- In 2008, HB 08-1168 created the financial literacy curriculum standards for K-12.

- In 2009, SB 09-256 made financial literacy a quality indicator under the individual career and academic plan.

- In 2020, SB 20-184 added to the financial literacy standards an understanding of costs associated with obtaining a postsecondary degree or credential, how to budget for and manage the payments for those costs, managing student loan debt, understanding credit cards and debt.

- In 2021, HB 21-1200 directed the SBOE to review during a recurring interval the standards relating to knowledge and skills students should acquire in financial literacy in ninth grade and 12th grade.

- In 2022, HB 22-1366 updated the financial literacy resource bank and the standards were strengthened.

- In 2025, HB 25-1192 requires a course in financial literacy as a graduation requirement.

Texas Timeline:

- In 2016-2017 academic year, the Texas SBOE requires every high school to offer students a personal financial literacy course as a half-credit social studies elective course.

- In 2021, SB 1063 was passed, creating the personal financial literacy and economics course and required high schools to offer it. The course content must be 75% personal financial literacy topics. This course can be counted toward the economics graduation requirement.

- In 2025, HB 27 requires every student to take a stand-alone financial literacy course to graduate.

Delaware Timeline:

- In 2015, HJR 4 established a task force to study financial literacy education and make recommendations on increasing students’ financial literacy.

- In 2016, the task force recommendations were presented to the SBOE and a modest level of content standards were adopted and went into effect in the 2018-2019 academic year.

- In 2024, HR 31 directed the state Department of Education to contract with the University of Delaware’s Institute for Public Administration and the Center for Economic Education and Entrepreneurship to conduct a curriculum alignment study for all local education agencies.

- In 2025, the legislature passes HB 203-1 unanimously and it is awaiting signature by the governor.

At the time of this publication, 29 states have a financial literacy requirement in place. There is continued momentum for K-12 financial education across the country. Passing legislation is just the first step. Ensuring that a quality course is thoughtfully implemented is just as important. Now is the time to ensure that the strongest requirements are implemented with full implementation still years away in many states.