News 2022

Updates from NEFE in 2022

National Endowment for Financial Education Announces Strategic Partnership Pilot Program

December 20, 2022

We recently committed $2 million for strategic partnerships with the Appalachian College Association and the Colorado Community College System.

NEFE Names First Innovation Award & Impact Award Recipients

December 16, 2022

We named the first Innovation and Impact Award recipients at the inaugural Financial Education Innovation and Impact Summit.

Nationwide Opinion Poll Gauges Financial Decision-Making Confidence and Resources of U.S. Adults

December 06, 2022

We followed up on our recent opinion poll of U.S. adults on types of personal finance decisions made by then exploring the reasons behind the confidence of those decisions.

#FinCon2022: A Retrospective

November 17, 2022

The NEFE staff who attended this year ranged from experienced FinCon participants to newbies. Each of them had a different perspective on their key takeaways.

Confidence in Making Personal Financial Decisions

October 28, 2022

When polled, 83% of U.S. adults admitted to making at least one personal finance-related decision over the past year.

What We’re Reading: Can Social Capital Supplement Financial Education

October 13, 2022

A Brookings research report highlights social capital in relation to bonding versus bridging, families, mentors and peer networks.

Opportunity Leads to Participation, According to Recent Poll on Financial Education Access

September 02, 2022

NEFE has collected new data, further substantiating how individuals with financial education opportunities choose to take it in overwhelming numbers.

NEFE Announces Nearly $500,000 in New Grants

September 01, 2022

Our next grant cycle opens September 15th.

Not all Mandates are Created Equal: a 2022 Legislative Recap

August 29, 2022

Our policy and advocacy team’s analysis of financial education bills and provisions from the most recent legislative session.

Understanding Racial Trauma's Impact on Financial Literacy

August 16, 2022

Personal finance programming likely does not capture the multi-layered texture of individual socioeconomic experiences and struggles.

In Context: Understanding Racial Trauma's Impact on Financial Literacy

August 16, 2022

We will continue to push for nuanced approaches to financial education: those that situate peoples’ experiences of systemic racism and trauma in context, and those that integrate culturally sensitive teaching.

Building (and Rebuilding) Trust in Higher Education: What Community Leaders Face

August 01, 2022

Lack of experience, trust and access to reputable financial funding sources is one of the key issues our Focus on FinEd Podcast Series Addresses.

How Race, Income Play a Role in Discriminatory Practices

July 28, 2022

Of those who have experienced discrimination or bias, a significant number attribute the reason to their identity or personal circumstances.

How LGBTQIA+ Representation Assures Better Data

July 19, 2022

Only when all individuals and families are provided a level playing field free of bias and discrimination will we truly be able to achieve economic stability.

Nearly 1 in 3 LGBTQIA+ Respondents Say They’ve Experienced Discrimination, Bias in Financial Services

June 24, 2022

This is a summary of a survey of 1,050 U.S. adults who identify as members of the LGBTQIA+ community and their interactions with the financial services sector.

Podcast Episode Seven: Recap – A Conversation with Nan Morrison

April 29, 2022

The final episode in our podcast series – a discussion between Dr. Billy Hensley (NEFE) and Nan Morrison (CEE)

Building Momentum for K-12 Financial Education

April 28, 2022

Legislative action, state support and access to trusted resources make a massive difference in leveling equitable financial education access for all students.

Poll: Most Adults Support Financial Education Mandates

April 25, 2022

New Data Highlights Demand During Financial Capability Month

A Reflection on the Research Brief: Financial Education Matters

April 21, 2022

Testing the Effectiveness of Financial Education Across 76 Randomized Experiments

Podcast Episode Six: How can we Better Align Financial Education to Support the Values and Contexts of Diverse Communities?

April 18, 2022

This episode reflects on the importance of placing a diversity, equity and inclusion lens on financial education.

NEFE Announces Research Commitment with RAND Corporation

April 12, 2022

Announcing a grant partnership with the RAND Corporation to research Income Share Agreements (ISAs).

The Importance of State Legislation to Financial Education Access

April 07, 2022

It is crucial that all students have access to financial quality education to equip them with the skills needed to navigate our increasingly complicated economic landscape.

What We’re Reading: Research Continues on Whether Financial Education is Effective

April 05, 2022

We partnered with FINRA and a renowned research team to highlight and amplify recently-published research that explores whether financial education programs affect financial knowledge and behaviors.

Podcast Episode Five: How to Better Support the Needs of Communities in Rural Areas

April 04, 2022

Host Raven Newberry interviews Chrystel Cornelius on how the conversations that happened during the policy convening event can evolve into logical next steps for communities to implement financial education.

Trauma after Trauma – Navigating Financial Anxiety in the Postpartum Period

March 28, 2022

Guest author and BlackFem founder Chloe B. McKenzie explores how financial trauma and financial shame can emerge for new mothers.

Podcast Episode 4: What Research Says is Effective in Financial Education and How Best to Support that with Legislative Dollars

March 24, 2022

Host Raven Newberry interviews Massachusetts’ State Treasurer Deborah Goldberg and Deputy Treasurer Alayna Van Tassel, who provide perspectives of policymakers, examples of initiatives they spearheaded in their state and the benefits of replicating them in other states.

NEFE Poll on Personal Finance Shows How Americans Ended 2021

March 21, 2022

New polling provides a snapshot of how U.S. adults viewed their financial quality of life at the end of 2021.

Podcast Episode 3: Alternative Approaches to Financial Education Mandates and Their Effectiveness

March 07, 2022

Host Raven Newberry interviews Heather Daly and Mike Bobbitt who provide methods, reasoning and examples for what kind of alternate programs can resonate in a community.

Podcast Episode 2: Financial Education’s Role in Equitable Access to Post-Secondary Education

February 14, 2022

Host Raven Newberry interviews Rachel Yanof as they discuss key takeaways and next steps from the policy convening topic: what role might financial education play in equitable access to postsecondary education and training?

Bankrate Names NEFE Best Financial Nonprofit in Social Honors

February 02, 2022

NEFE named Best Financial Nonprofit for bringing financial awareness and education to the masses.

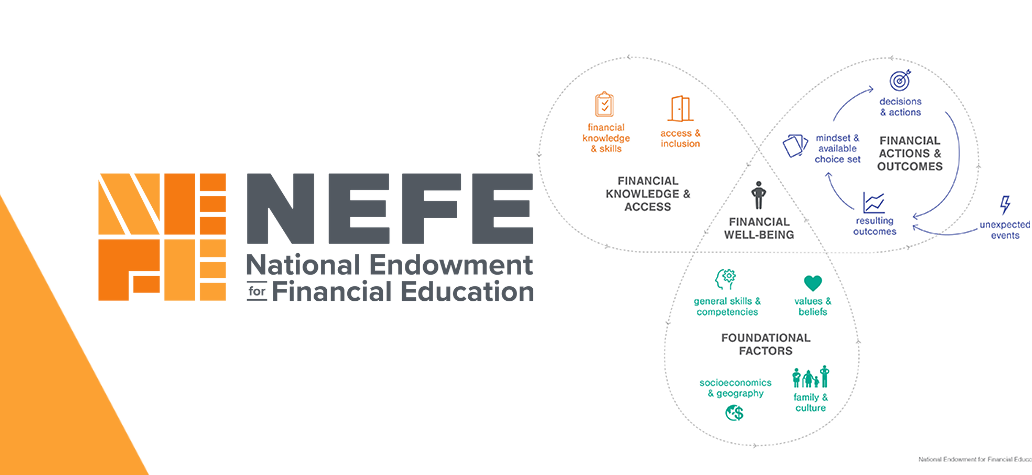

NEFE Updates Personal Finance Ecosystem With New Design; Focus on Inclusion

January 31, 2022

NEFE has updated its Personal Finance Ecosystem, a research-informed framework to help understand the many factors that comprise and influence an individual’s financial well-being.